Received a IDFC First Bank card. Not sure if I applied for it. What exactly is this?

- 37529

- 64

-

- Last Comment

Anyone know what exactly is this?

Is this a debit card or a credit card or a prepaid card or something else?

How did they got my info (Name, address and phone number) when I have not applied for it?

"@rogerthat":https://www.desidime.com/users/...14 "@androgame":https://www.desidime.com/users/...51 "@A2Zdeals":https://www.desidime.com/users/...67 "@Tejaa":https://www.desidime.com/users/...94

- Sort By

That’s possible. Although there is no new CIBIL enquiry made on my account.

https://www.capitalfirst.com/easy-buy-em...rd

Supposed to be given to customers of IDFC bank having durable or 2 wheeler loan from IDFC.

You will be eligible for an EMI card after successful clearance of your 1st 4 EMIs. The card will be dispatched to you after 45 days from payment of the 4th EMI.

no idea bro

maybe on likes of Bajaj finserv card as suggested by other members

i would suggest going against them officially for this non sense.

this is fraud prone area.

Yes it is a scam… sending cards to random people. Talking to IDFC First bank cc and they are clueless about how and why I got it.. Instead of helping me they are convincing me to keep the card and listing me all the benefits.

Seems like EMI only card .

Just talked to IDFC First Bank cc and they said it’s a EMI card, but they have no idea about how and why I got it.

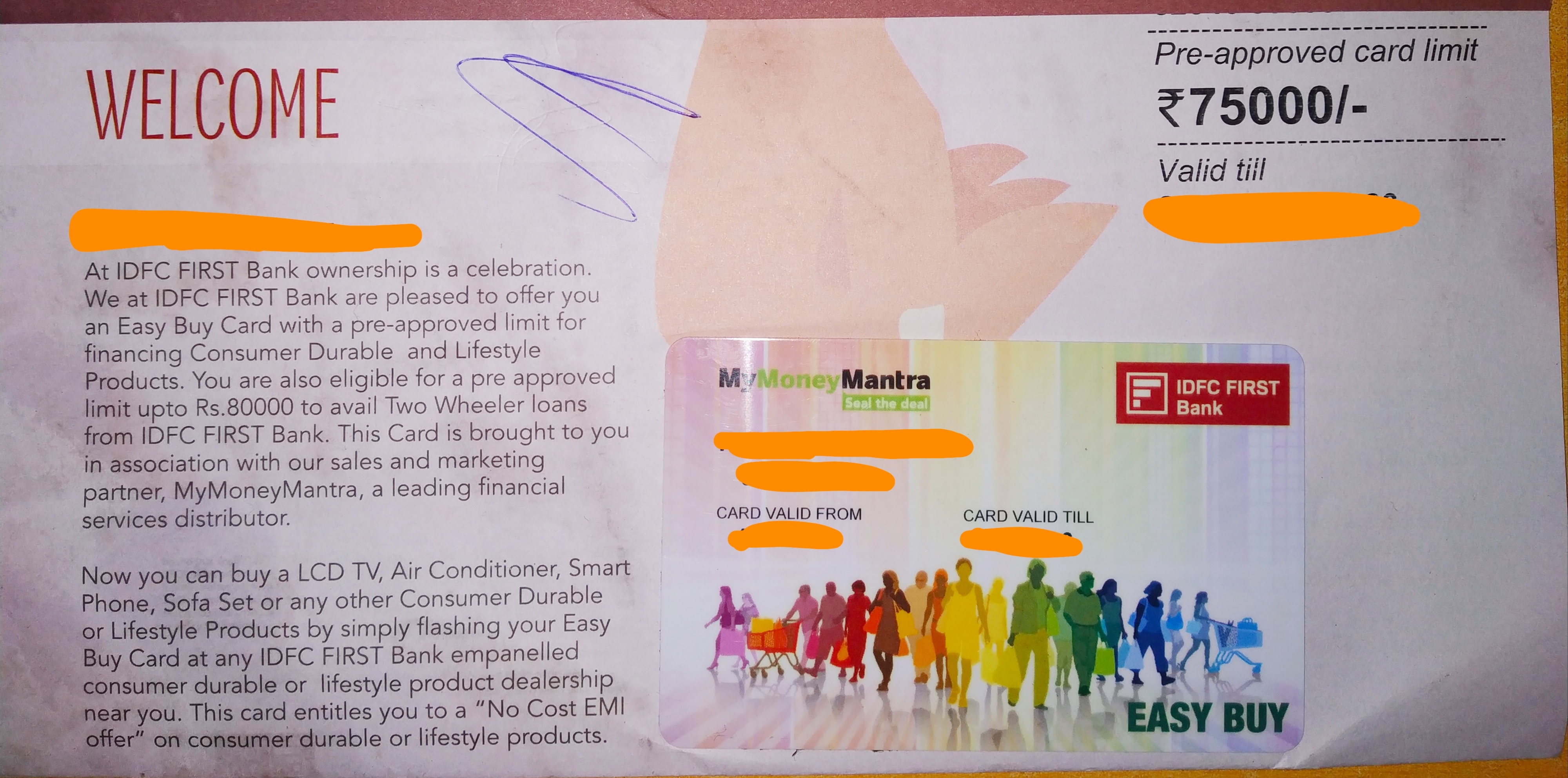

This a no-cost EMI Card from Capital First, similar to Bajaj Finserv card. As IDFC bank recently merged with Capital First, so they are issuing one EMI card for the existing bank customers also with a pre-approved limit. You can be able to use it to purchase in local electronics appliance store if they support Capital First. If you do not want to keep it, just send an email to that email address mentioned in the document received with the card. I too got one. There will be no enquiry in CIBIL for that. This is not active unless you use the card.

Thank you. That’s exactly what I am going to do. This card looks pretty useless to me.

Did you keep the card or return it? Any charges if I return it?

I dont have credit card yet.. in hdfc net banking offering me life time free credit card with 1500 amazon voucher.. i am not sure what is tc.. what else could be catch.. as i am newbi on credit card part.. what kind of credit card it will be?

Most probably they are offering MoneyBack card which is LTF. This is their entry level card. I have it too.

Get it if it is a LTF card.

EMI only card like Bajaj Finance… Mostly no use

Yes, it’s like that. No use for me either.

Off topic. How to get cibil score? Is it free to check?

Only once in a year as per RBI directions,you can create a free acc on CIBIL site using this link(keep your pan number ready):

https://myscore.cibil.com/CreditView/enrollShor...

I too received same kind of card having 75000 limit, at first I don’t have any clue how these people got my office address and my full name

UPDATE: IDFC First Bank has cancelled my card.

On request of IDFC CC, I had sent an email on [email protected] asking why I was issued this card without my consent. It was practically a long rant. And I didn’t receive any reply for my email. Just when I was thinking about sending another email, I noticed that I received a SMS on Saturday that my card has been withdrawn.

Happy ending!

Thanks all of you for helping me.

Just now wrote a short and sweet email to id shared by you

had no patience to type long

…@Roushh …in financial matters when u r in doubt…even slight doubt…get it cancelled..ASAP….

when in doubt one can follow kids approach:

Kid A : Bol Pencil

Kid B : Pencil

Kid A : Teri shaadi cancel

as simple as that and without anymore guessing just cancel it

So @Roushh got this got because of Flipkart Pay Later (Powered by IDFC First Bank)

and this 75k should be reflecting as a personal loan in CIBIL

Ref: https://www.desidime.com/forums/dost-and-dimes/...

I also activated Flipkart paylater, but don’t get any card like this

I was not having any previous Credit History so my Credit Score was NIL and with purpose of building it gradually, I have activated both Amazon Pay Later and Flipkart Pay Later, few Months back.

Amazon Pay Later has Capital Float as Lending Partner and sanctioned Credit Limit of ₹10000 in this account, while Flipkart Pay Later has IDFC FIRST Bank as Lending Partner and sanctioned Credit Limit of ₹5000 in this account.

Now, when I have checked my Credit Score via One Score, Wishfin, Paisabazaar etc., both Experian and CIBIL Scores have improved from its NIL Status.

Amazon Pay Later is reflecting in both Experian and CIBIL as an Active Consumer Loan with sanctioned amount of ₹2000 by Capital Float, while Flipkart Pay Later is reflecting only in Experian as an Active Personal Loan with sanctioned amount of ₹5000 by IDFC FIRST Bank.

I think this Persona Loan of ₹5000 by IDFC FIRST Bank should also be reflected into my CIBIL Report, as it will help me in improving score, if I do transactions with Flipkart Pay Later on Flipkart and PhonePe and later do timely repayments. But if they don’t show this Personal Loan in CIBIL and won’t report its timely repayments then it won’t affect CIBIL Score at all.

Contacted Flipkart over its IVR but there is no option to talk to their CS Agent, even selected option for applying Flipkart Axis Bank Credit Card, but even after facing call waiting for more than 60 minutes even, no Agent got connected. Tried many such failed attempts.

After lot of frustrations approached IDFC FIRST Bank over 1860 500 9900 and explained this issue, nut they are not able to check my Loan Account details in their databse. Now, I wonder then how the same Personal Loan is reflecting in Experian Report, in their name. Contacted them multiple times.

Initially they didn’t helped in any way and told to contact Flipkart for any query related to Flipkart Pay Later account, but after few attempts, I was able to convince their one of the executive that they are Lending Partners, thus they sanction Loan amount and not Flipkart, they generate inquiries with Credit Agencies and report it as Active Loan and its usage & repayments, then he somewhat convinced to my logic an ready to help.

He has provided me this banker(at)idfcfirstbank(dot)com email id and informed to write my issue and attach copies of Credit Reports of Experian and CIBIL to them, then their concern team will revert back to my mail and will also receive follow up call from them in this regard and provide correct resolution.

So now, I want help & guidance from experienced dimers that what should I do in such a scenario? should I go ahead with this or avoid reporting in CIBIL by IDFC FIRST Bank, as some dimers faced issue of much higher Loan Amounts like ₹60000, ₹75000 etc. reported by them in their CIBIL Report.

I am quite confused as not having much knowledge of Credit Products and Services, so please provide your valuable suggestions.

It seems like a third-party credit card provider like Bajaj Finserv. Saw a few complaints on twitter too. Complaint to IDFC First bank and get it closed. Report the same thing to CIBIL, get it removed from CIBIL report.