- Home

- / Personal Finance

- / Home Loans EMI - How to save on your EMI?

- 908 Views

- 4 Comments

- Last comment

Home Loans EMI - How to save on your EMI?

Simple Tips & Suggestions to save thousands on your Home Loan

Having a home loan and finding it harder to pay your regular EMI due to salary cuts or loss in business or personal income? Covid-19 has bought forward some of the most unexpected financial planning problems and you are not alone, if you are facing problems or struggling to pay your Home Loan EMIs. We have highlighted many ways using which you can manage your EMI better and stay on top of your Credit Score and keep your Credit history clean.

The “Debt Trap” is the worst thing you would want to get into during this recession-like situation as interest rates can quickly pile up along with Late Fees, Penalty etc making a very horrendous situation to be in. We have put down concrete steps and suggestions and we assure you that it will be well spent 90 minutes to get things in order and save Lakhs of Rupees over the next 10-15 years.

Every Home loan EMI has 2 components - Principal and Interest Component. In the earlier years of your loan, you end up paying a higher interest component and a much lower principal component. As your principal keeps reducing, your interest component also keeps going down. The Home Loan is given to you for a fixed number of years, often called “Loan Tenure”. And the final element which matters the most is Interest Rate or Home Loan Rate. Interest rate can either be Fixed rate or Floating rate. Fixed rate means that your interest rate would stay the same irregardless of any changes by RBI. Floating Rate usually means that your interest rates are revised every quarter based on the Repo rate (Rate decided by RBI). All these basic elements are linked to each other and you need to understand these elements first by downloading your latest Home Loan statement.

- EMI amount

- Original Loan Tenure

- Balance Loan Tenure

- Interest Rate

- Principal Component vs Interest Component

If you start repaying a higher amount compared to your EMI, your loan Tenure automatically decreases and so does your future interest (as you are paying off additional principal). Similarly, if the interest rate is reduced on your loan and you continue to pay the original EMI, your remaining loan tenure decreases at a faster rate.

If you read news regularly, you might be aware that RBI has been aggressively cutting down Repo Rates every month to bring in more liquidity in Indian market, given the recession-like situation. In May 2020, RBI cut the repo rate from 4.4 percent to 4 percent. That’s a 40 basis point rate cut. This follows the rate reduction of 25 basis points in mid-April and 75 basis points on March 27. However, these rate cuts are meant for Banks and All Banks will not aggressively pass the same rate cuts to all customers.

You will have to do some work! Banks would obviously like to make some money. While they may quickly hike interest rates when Repo rates are increased, It’s very common for Banks to delay when it comes to slashing interest rates and passing on the benefits to customers. The usual strategy of Private banks is to slowly watch PSU Banks like SBI etc for rate cuts and then they follow their footsteps, earning good interest meanwhile.

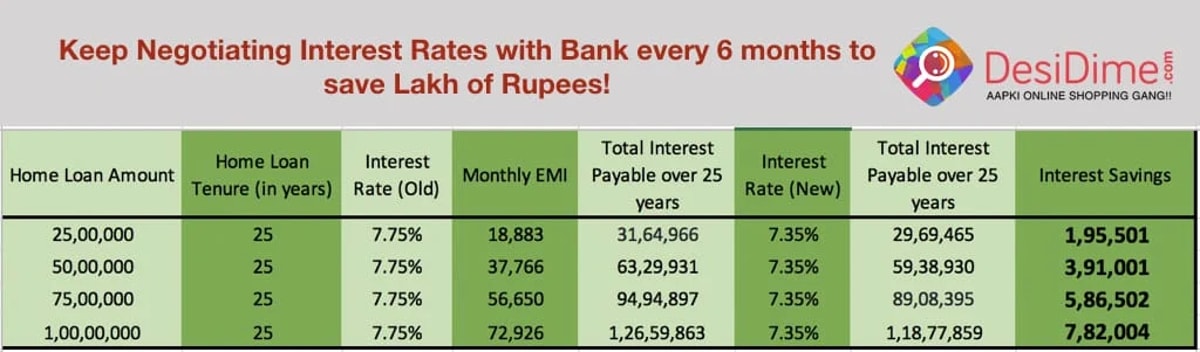

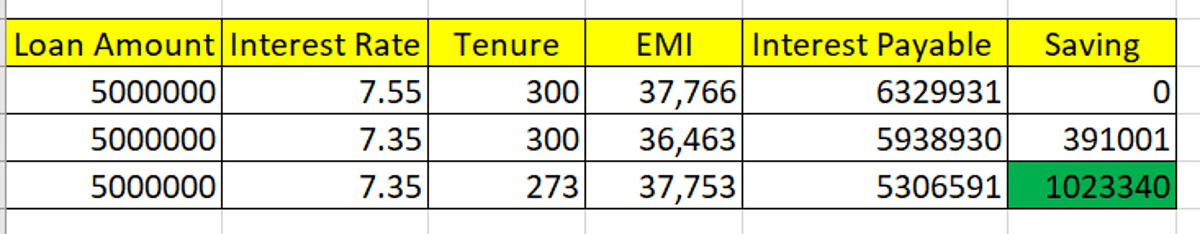

Let’s understand the maths first behind the rate cut and how a 0.25% lower interest rate can help you to save Lakhs of rupees over the entire loan tenure.

Let's assume that you have taken a Home Loan of 50 Lakh rupees for a tenure of 25 years and your current interest rate is 7.75%. If you switch to a bank offering 7.35% interest rate or convince your existing bank to give you a lower interest rate, You end up saving Rs. 3,91,000. Yes, A whopping Rs. 3.9 Lakh is straight in your pocket

A wise Dimer "@nhavale":https://www.desidime.com/users/85388 also shared a very important thing in comments: One can reduce tenure also if EMI is affordable and that can save upto Rs. 10.23 Lakh in the above example. So, if you are keeping money in FD, then obviously you must reduce tenure and pay away as much as you can.

So, Do some homework on popular websites like Bank Bazaar or SwitchMe and Call your bank and explain to them how you are getting lower rates with other banks and you are considering switching the Home Loan. No bank would like to lose a good customer and they would generally give you the best possible rates. It may not be exactly the same as the lowest available on BankBazaar but you must also consider switching costs etc. It’s not advisable to switch banks or do a balance transfer until you are saving more than 1% in interest rate.

Also, Do not forget that it's not a one-time exercise. You need to analyze/research this every 6 months and you are bound to save some serious money!

If you had taken Home Loan after July 1, 2010 but before April 1, 2016, then there is a very high likelihood that your Loan rate is linked to Lending Bank’s Base Rate. If you are under the Base Rate Regime, it's likely that your interest rate might be upwards of 10%.

A new regime of lending called marginal cost of funds based lending rate (MCLR) was announced and implemented by RBI for all loans, including Home Loans, disbursed after April 1 2016. The new MCLR regime makes it compulsory for the Banks to pass on rate changes to customers faster without any request by the customer. One of the most favourable decisions made by RBI keeping end-consumers in mind.

So now you must be wondering, Can I not take benefits of MCLR if I took Home Loan before 2016? Do I need to call the Bank every 6 months? RBI in its guidelines have made it very clear that customers must be allowed to switch to MCLR from Base Rate without paying any additional Fees. So you have full legal right to switch your home loan to MCLR rate by just calling the bank and requesting the same. All Banking executives are normally aware about it and they will guide you. Obviously, you must only do this if your existing rate is higher than MCLR Rate.

MCLR rates are released by RBI every month here or you can also see the MCLR rates for popular banks on BankBazaar.

If your loan is in the BPLR (Benchmark Prime Lending Rate) regime, you can still call and switch to MCLR rate if it makes sense financially. Simply ask your banker about the current MCLR rate vs your interest rate and they will always guide you.

If you had taken a loan from a Housing Finance Company (HFC) and not a bank, then as per RBI regulations, HFC are not obliged to switch customers to MCLR. In such cases, you can consider doing your Balance Transfer to another bank and there are many websites like BankBazaar or SwitchMe to help you transfer.

The risk with MCLR is that in events of rapidly falling interest rates, the banks may reset the interest rate after 12 months if it's linked to the 12 month MCLR rate. So one need to negotiate to link their loan to quarterly or 6 months MCLR to really avail the benefits.

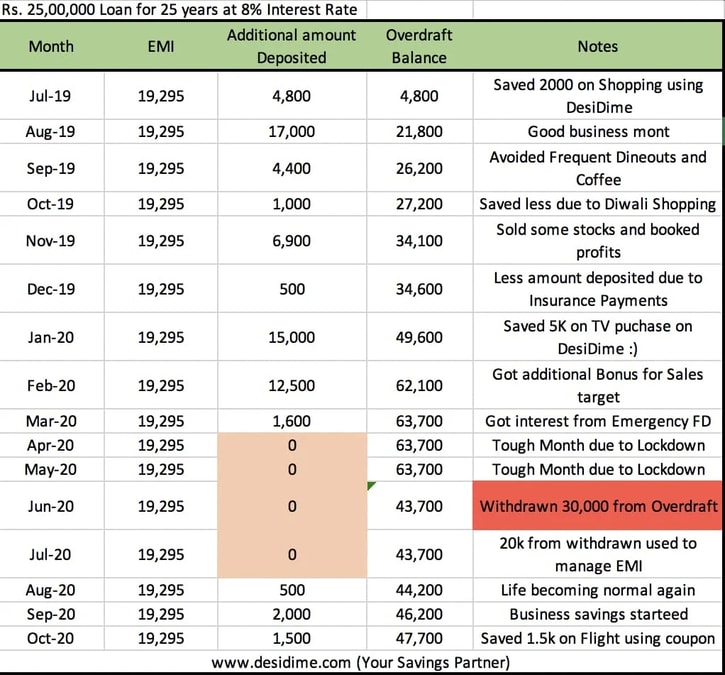

If you are not salaried and running a business, there is a likelihood that your income is not steady and keeps varying every month. In such cases, it often happens that during your good business months, you might be over-spending on luxuries or discretionary spends. Or you might simply be depositing the money in FD while paying a higher interest rate for your Home Loan. During an unplanned crisis like Covid19 or say floods or earthquakes or simply cyclical nature of your business, one can experience a huge drop in business income. If the above resonates with you, then you must consider opting for Home Loan Overdraft Facility. In simple terms, You simply pay more than your EMI amount during your good months and the excess amount paid is deposited in the Overdraft account. The amount also offsets your principal amount which helps you to keep reducing your Interest component every month or total interest payable.

During a crisis or say a bad few months, you can also withdraw the overdraft money to support you and your family. The overdraft money can also be used to pay EMI after withdrawal in case you are struggling with your EMI payments too. The beauty of Home Loan Overdraft Facility is the discipline it brings to you to prepare for worst-case scenarios like Lockdowns where we saw many businesses going to Zero revenue overnight.

Suppose you have a Home Loan of 25 Lakhs for 25 years at 8% Interest rate and you have availed Home Loan Overdraft Facility. Your monthly EMI would be Rs. 19,295. Here is how an Overdraft facility looks like:

Above from helping during tough times, the Overdraft Balance also offsets your principal by the same amount. So essentially, you are paying lesser interest or replaying your loan faster

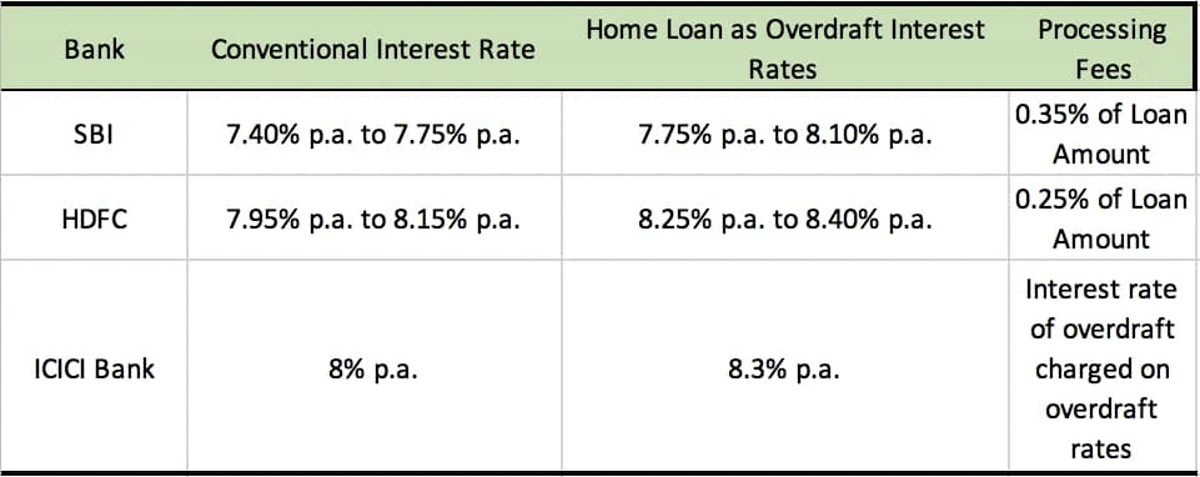

While it sounds all exciting, Do not jump for Overdraft Balance facility unless you have a very varying income stream. The interest rate of Home Loan with Overdraft Balance facility is +slightly higher+ than a conventional Home Loan. So one needs to do some calculations on an excel to figure out the true benefits of such a Facility. Also all banks have different variations in Interest rates.

Source: BankBazaar, May 2020

This is one of the most powerful weapons in your arsenal to reduce or eliminate your Future EMIs. The biggest hack is to prepay as much as possible in your earlier years of Home loan. If you are able to knock down your principal component in the first 5 years of your home loan, you can save upto 50% on your total interest payable.

Obviously one should only prepay aggressively after the individual has enough savings or emergency funds available. Every opportunity to prepay must be looked at. Are you creating a Fixed deposit as you don’t have ideas to invest? Consider prepaying the amount as your FD interest rate will always be lower than your Home Loan interest rate.

Got an unexpected annual bonus from the company for all your hard work apart from your regular Salary? A very good business month? Avoid discretionary spending and consider the Home loan pre-payment. Salary hike of 20%? Why not pay 5% extra EMI every month from the additional salary.

Be very aggressive with pre-payments in first 5 years of Loan Tenure.

Let me explain how this can be done with an example. Say you availed a home loan of Rs 25 lakh at 8% p.a. for a tenure of 25 years. Every year you managed to pay Rs. 40,000 as pre-payment for the first 5 years. This would lead to overall interest saving of Rs 6,03,264 and a reduction of loan tenure from 270 months (25 years) to 241 months, i.e., a reduction of 29 months.

We hope that the above suggestions help you to better manage your Home Loan and save on your Future EMIs. Spend a good 2-3 hours every 6 months to research and evaluate your options and don’t forget to call your banker. You would be very surprised to learn that you save a couple of Lakhs by just giving a phone call.

Do share with us your experiences in the comments below.

Follow Us

Follow Us

![How to do Rent Payment by Credit Card without Charges? [Effectively]](https://cdn2.desidime.com/topics/photos/1776967/medium/Rent-Payment-Through-Credit-Card-1-768x511.jpg?1713442945)

I have a home loan with axis bank and received this sms in April. After that no revision done.

“Dear customer, MCLR reset effect has been passed on to your loan a/c no. XXX. Your revised ROI is 8.00 % wef 18-04-2020. Thank you.”

Please suggest if anything better can be done.

As suggested in article, Check other Loan options. Call the bank and negotiate… Tell them that you will switch, if you are not offered better interest rates… Convince them that you pay on time, you are good customer and you dont want to switch for few basis points but bank has to make it little better. Repeat every quarter.

Even if you get 0.1% to 0.2% down, You can be rest assured that you have got the sweetest deal (maybe 10-15 loots of Desidime )

)