- Home

- / Personal Finance

- / IPO Alert - Mazagon Dock Shipbuilders, UTI AMC and Likhitha Infrastructure -...

- 908 Views

- 4 Comments

- Last comment

IPO Alert - Mazagon Dock Shipbuilders, UTI AMC and Likhitha Infrastructure - Should you subscribe?

As 2nd Day subscription updates pour in, We share Community's Final Verdict on these IPO Listings

IPO or Initial Public Offerings are a great way to participate in Listing gains due to high interest from Investors. While Dimers already discuss IPO in depth within DesiDime forums, We now bring this to our "Personal Finance" section as Good IPO is nothing short of a Hot Deal one can grab or wish to grab.

Three IPOs opened for subscription on 29th September - Rs 2159.88Cr UTI Asset Management Company (AMC), Rs 443.69 crore Mazagon Dock Shipbuilders and Rs 61.20 crore Likhitha Infrastructure.

Mazagon Dock IPO

State-owned defence firm Mazagon Dock Shipbuilders Ltd (MDL) is the India's leading defence public sector undertaking shipyard under the Ministry of Defence. It has 2 main divisions - The Shipbuilding division (for Naval Ships) and the Submarine and Heavy Engineering Division (for Warships, Missile Boats etc). It has strong order book and financials and the Government is selling 15.17% in the PSU.

Lets quickly look at key details

| IPO Price | Rs. 135 to Rs. 145 per equity share |

| Lot Size | 103 Shares |

| Bidding Last Date | October 1st |

| IPO Allotment | October 7th |

IPO Listing Date |

October 12th |

| Current Retail Subscription Status | 15.53 times on Day 2 |

| Grey Market Premium | 80 to 100% currently |

Overall, the stock looks very good for Listing gains as one can expect Listing gains of upwards of 50% upto 100%. While there is no guarantee about the same, It looks a Safe IPO to bid for.

UTI Asset Management Company Ltd IPO

UTI AMC is the 3rd asset management company to get listed on the stock exchanges after Nippon Life India AMC and HDFC AMC. Incorporated in 2002, Its the largest AMC in terms of Total AUM. It runs an impressive 178 domestic mutual fund schemes and sponsored by Govt firms like LIC, SBI, PNB and Bank of Baroda with each one having 18.24 percent pre-offer stake in the company. For Q1FY21, UTI reported profit of Rs 101.1 crore and its main source of income is management fees, marketing fees and investor services fees as one would expect in AMC.

| IPO Price | Rs. 552 to Rs. 554 per equity share |

| Lot Size | 27 shares |

| Bidding Last Date | October 1st |

| IPO Allotment | October 7th |

IPO Listing Date |

October 12th |

| Current Retail Subscription Status | 1.15 times on Day 2 |

| Grey Market Premium | Around 10% |

UTI AMC can list at a premium of 10% to 20% on listing day. However, one can subscribe for it only if they feel aggressive about the AMC business. Avoid it otherwise or wait till 2PM for subscription data.

Likhitha Infrastructure Ltd IPO

IPO of Hyderabad-based Likhitha Infrastructure, an oil & gas pipeline infrastructure service provider gets listed on October 12th on stock market while the bidding ends on 1st October. The business is focused on laying pipeline networks, providing operations & maintenance services to the City Gas Distribution (CGD) Companies in India. Company is bringing the IPO issue at P/E multiple of approximately 12x at Rs 120 per share on post issue FY20 PAT basis.

| IPO Price | Rs. 117 to Rs. 120 per equity share |

| Lot Size | 125 shares |

| Bidding Last Date | October 1st |

| IPO Allotment | October 7th |

IPO Listing Date |

October 12th |

| Current Retail Subscription Status | 7.5 times on Day 2 |

| Grey Market Premium | Around 10% |

While the retail subscription seems decent on day 2, One can avoid the IPO as there is a likelihood that it can open weak if the market is weak on 12th October.

What Do Dimers say?

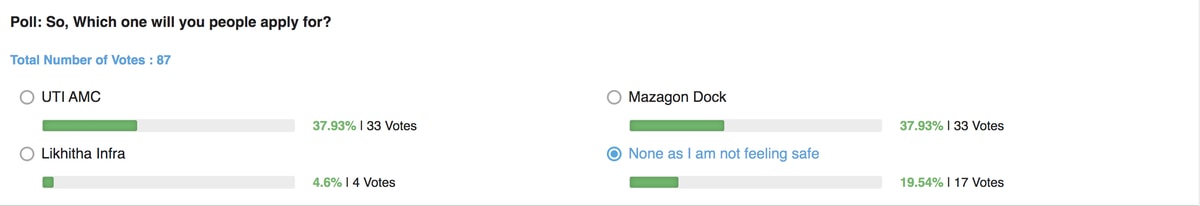

Dimers have already discussed about these 3 IPOs and even voted on which IPO to bid for.

While the above votes also suggest UTI AMC strongly, One must also read the comments in that thread as Dimers Sentiment have changed post subscription details of Day 1 and Day 2. You can find the entire discussion thread here.

Which IPO are you subscribing for? Do share your thoughts in comments below.

Follow Us

Follow Us

![How to do Rent Payment by Credit Card without Charges? [Effectively]](https://cdn1.desidime.com/topics/photos/1776967/medium/Rent-Payment-Through-Credit-Card-1-768x511.jpg?1713442945)