- Home

- / Personal Finance

- / Top 5 Lifetime Free Credit Cards in India in 2024

- 908 Views

- 4 Comments

- Last comment

Top 5 Lifetime Free Credit Cards in India in 2024

Grab the Top 5 Lifetime Free Credit Cards which have got exclusive benefits on Shopping, Fuel, Entertainment, Food, Utility Bills, Insurance Premiums, and much more.

A Lifetime Free Credit Card gives you many benefits on shopping, fuel, entertainment, food, utility bills, and more. Moreover, you don’t have to pay any joining or annual fees for this card. Therefore, if you are looking for one then we have got you the Top 5 Lifetime Free Credit Cards in India in 2024. These cards have proved their worth in the past and are expected to rule this year as well so let’s have a look.

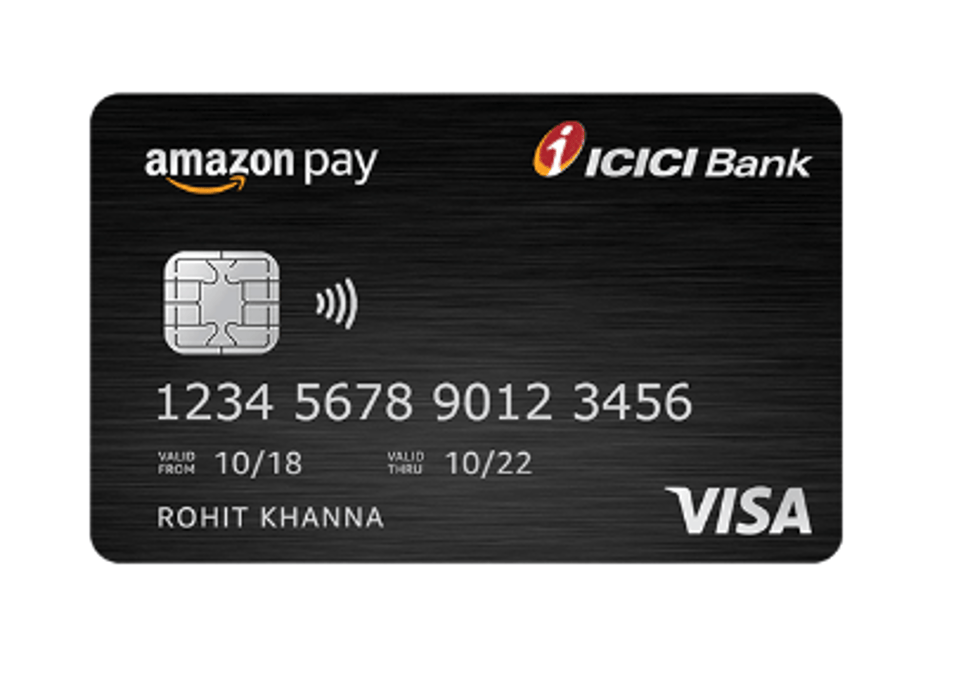

The Amazon Pay ICICI Card is offering up to 5% cashback on Amazon and 1% flat cashback on all other payments. It is co-branded with Amazon. This card has gained popularity in India due to its lifetime free feature.

This card has Rs 0 annual fees and thus is best suited for shopping. The best feature here is that you get 1% cashback on all transactions. Moreover, Amazon Prime members get 5% cashback every time on their transactions on Amazon. Besides, non-prime members get 3% cashback on Amazon.

The ICICI Bank Amazon Pay Credit Card has great offers on dining. It’s ICICI Bank Culinary Treats Program is one of them. Additionally, you get a min 15% discount on your dining expenses at all the tied-up restaurants.

This card has in-built contact less payment feature. You can earn reward points and then redeem it for cash which is a great advantage here. Talking about benefits, you get 25% discount twice a month on movie tickets via BookMyShow. Moreover, it has low interest rates so you can afford it. In addition, it also gives fixed deposit interests.

This card comes with free joining. Here, you get 2 ClearTrip gift vouchers worth Rs 1000 after your 1st transaction. Moreover, it gives 10% cashback on spending done within the first 90 days. Additionally, enjoy 3X bonus points in which you get 6 points on every Rs 150 spent on dining, telecom, hotels, and other categories.

1. 1st Year – 0

2. 2nd Year Onwards – 999. Waived on annual spends > 1 lakh

3. APR – 37.2% per annum

The Kotak Bank Royale Signature Credit Card gives 2 free airport lounge visits per quarter at domestic airports in India. Then, you get 1% fuel surcharge waiver upto Rs 3500/year on all the fuel transactions between Rs 500-3000. Moreover, you get railway surcharge waiver of upto Rs 500/year.

You get 4X reward points for every Rs 150 on dining, travel, air tickets, and international spends. Besides, grab 2X points on all other categories. One can pay with their reward. Once shopping is done you can ask the cashier to pay bill with your reward points at time of payment. You can also redeem points via net-banking.

You can avail of cash withdrawal of up to 100% of the limit on your credit card. Moreover, you will get a free credit period of up to 50 days on any purchases made on your card, with no charges levied. Besides, you have the flexibility to choose your own credit limit.

This card comes with exciting eDGE loyalty reward program. Additionally, when you Spend Rs 200 on Domestic then you earn 6 reward points. On the other hand when you spend Rs 200 on International then you earn 12 reward points. Besides, get 100 reward points on your 1st online transaction.

These were the top lifetime free credit cards. Which according to you is the best one and why? Do let us know in the comments below. A special thanks to our Dimer Rosh_0007 for the content in this article. You can also share your experiences with these type of credit cards below. You can also have a look on Top 5 ETFs in India to invest in 2021 using SIP.

Follow Us

Follow Us

![How to do Rent Payment by Credit Card without Charges? [Effectively]](https://cdn0.desidime.com/topics/photos/1776967/medium/Rent-Payment-Through-Credit-Card-1-768x511.jpg?1713442945)

So its not LTF right? Should not be part of your post or your post header is misleading?