HDFC Millennia Credit Card Review

- 5320

- 40

-

- Last Comment

HDFC Bank last year launched Millennia series of credit/debit/prepaid cards for Millennials and here we’re going to see a very detailed review of the HDFC Millennia Credit Card.

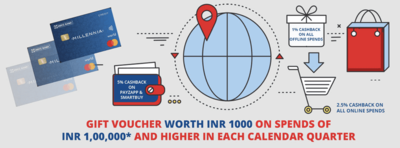

- Launch Offer: INR 1000 worth gift vouchers on spends of INR 1,00,000 and above in each calendar quarter (first year only).

- Launch/activation offer keeps changing with HDFC Bank, so check with the bank about the same while applying.

- That aside, the joining/renewal fee waiver conditions are pretty good for the card of this range.

- Note that HDFC usually gives most credit cards as First Year Free if you’re upgrading, and now during Diwali it seems they’re back with the Lifetime Free cards as well.

Reward Redemptions

- 1 CashPoint = INR 1 (for stmt credit)

- 1 CashPoint = INR 0.30 (for flight/hotel redemption)

- Redemption requirement: Min. of 2500 Points (for stmt credit)

- If you’ve followed all above rules to earn the rewards now you’ve another check-point to pass, as the minimum points required to redeem your points for statement credit is set to: 2500 reward points.

With this rule in place, combined with validity of points, hardly ~10% of the customers could actually redeem the points.

As a part of launch offer you get Rs.1K voucher every quarter on spending 1L. Fortunately fulfilment of this reward is pretty fast than expected. It came within ~2 weeks of completing the transaction.

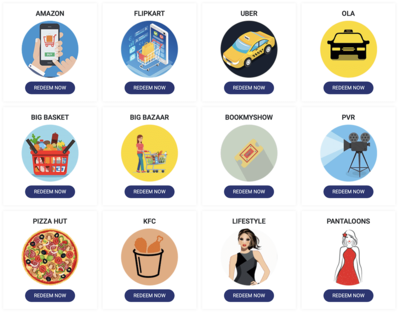

For the rewards, they have quite a list of brands as below, but as always Amazon voucher is the best and it was available for instant redemption.

- Groups

-

Credit Card

Credit Card

- Sort By

Just an information to our dimers!

I got upgrade option but from whom I will check regarding lifetime free or first year free.

Check with your RM

Check in netbanking also, it should show

Vu+kg

OP, Post for DCB also with best usage, conversion etc…

I am using this card from June. Missed first quarter benefit but after than successfully claimed two quarter benefit of 1000 amzon voucher on spend of 1lakh. Reward point accumulated 4500 apart from smartbuy cashback.

Best for people having moderate spends. Buying Amazon voucher from smartbuy with 5% cashback and 5% smartbuy cashback is great.

what are options to claim reward for this cc ?

and any charges for claiming rewards ?

Not received any cashback for nobroker since last 3 months, any one confirm millennia card card gives additional 5% cashback for payzapp or not

i also didnt get reward points, only 126 reward points are getting credited for paying Rs 12625 rent for paying in no broker through payzapp

Any one complained to hdfc bank ?

This card is the worst if you have multiple cards . 2500 is the min amt to redeem for statement credit . Also the points expire in 1 year

Source: https://v1.hdfcbank.com/assets/pdf/Millennia-Cr...

Feature 1: Earn 5% cashback on spends done via PayZapp and SmartBuy

As a launch offer, the maximum CashBack that can be accrued on your spends/shopping via Payzapp and Smartbuy will be Rs. 1000 per month for the first six months post issuance of the card

Cashback will be capped at Rs 750 per month after 6 months

Minimum transaction value to avail the cashback is Rs 2000

@hotchap @piyush2251

If I pay electricity bill of 2k+ From PayZapp using a millennia credit card, will I get 5% infinia CB and the PayZapp normal CB?

You will get payzapp CB using the code plus millennia reward point and 5% smartbuy cashback.

P.S- never tried bill payment through payzapp using millennia so not sure about smartbuy cashback but according to T&Cs one should get it.

Will request experienced guys with millenia to pls help on the above questions if possible

@nandamuri.balakrishna or @SupportFARMER or @ashmail123957

![Price Drop - POCO M6 5G (Galactic Black, 128 GB) (4 GB RAM) [User Specific]](https://cdn1.desidime.com/topics/photos/1787165/medium/-original-imagytcpcnjbduwh.jpeg?1715071153)

Why copy-paste from cardexpert website in this forum