Dharmaj Crop Guard Limited IPO is now open for subscription and its price band is ₹216 to ₹237 per share. The initial public offering of Dharmaj Ltd. will be open from 28th to 30th November. Its GMP today is around Rs 52 and experts believe that this IPO may open at a premium in the stock market. The listing date of Dharmaj Crop Guard Ltd. is on 8th December. Moreover, the total IPO issue sums up to ₹216 crores, excluding the 14.83 lakh equity shares on an offer-for-sale. Here are all the latest details of the Dharmaj IPO.

Dharmaj Crop Guard Ltd., established in 2015, is a leading manufacturer and distributor of agrochemicals such as insecticides, fungicides, herbicides, plant growth regulators, and more. The company also acts as a marketing firm for other brands that deal in the same category. Thus, all-in-all, Dharmaj Crop Guard helps farmers with crop protection, productivity, and profitability.

Now that the agrochemicals company is about to make its way into the Indian share market, investors are willing to know more about Dharmaj and its IPO issue. If things go well for the company, it would use the investors' money to further expand the business. So, let us talk more about the IPO issue of this Gujrat based pesticide manufacturing company.

Dharmaj Crop Guard IPO Full Details and Review

There are certain aspects that need to be considered whenever we talk about a company’s IPO issue. These aspects may explain whether an IPO would perform better or worse in the share market. And as well all trade and invest with just one intention, profit, it is important to first understand what a company has to offer and whether it can be beneficiary for us or not. Therefore, we have talked about certain parameters of the Dharmaj Crop Guard IPO issue right below:

Dharmaj Crop Guard Limited IPO GMP Today: 28th November 2022

Dharmaj Crop Guard Ltd. IPO GMP today is ₹52. A GMP of Rs 52 for Dharmaj shows that the company has a chance to perform well on its debut day in the stock market.

Note that this data is updated on the 29th of November and the grey market premium of any company can change with time. Thus, we will keep updating the post for the same.

GMP stands for Grey Market Premium and it shows the price at which investors are applying for an IPO. If the GMP is higher, the IPO would probably open at a premium in the share market. Though, things may get ugly if the GMP of an IPO is lower.

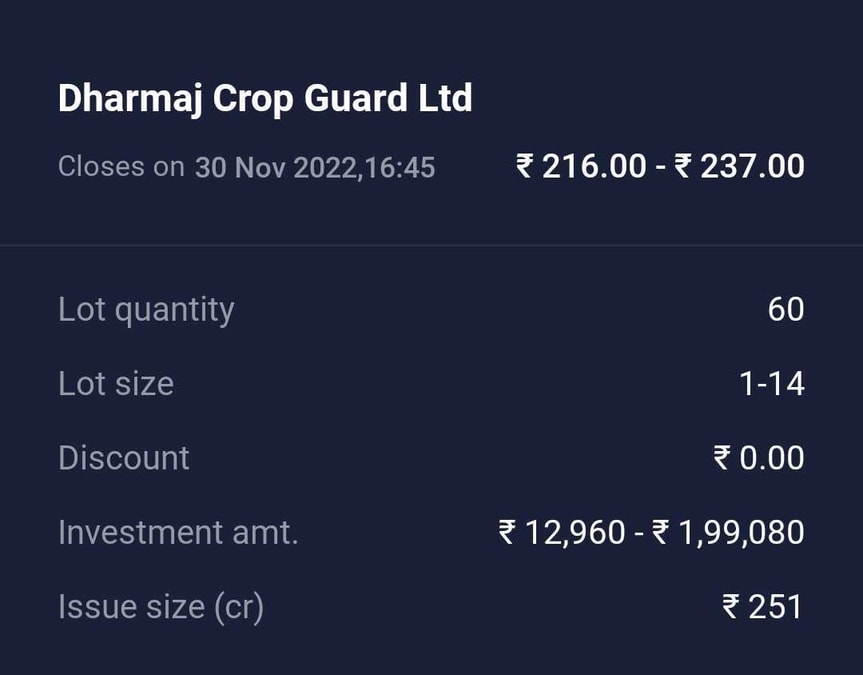

Dharmaj IPO Price Band: ₹216-237 & OFS by Existing Shareholders

The price band set for Dharmaj’s IPO is from Rs 216 to Rs 237. Thus, investors can apply for one or more lots of shares within the same price range. Also, the existing shareholders of the company have offered their shares for sale too. These are a total of 14.83 lakh equity shares that are available for OFS.

So if Dharmaj’s IPO gets subscribed fully at the upper end of its price band, the company would get nearly Rs 250 crores.

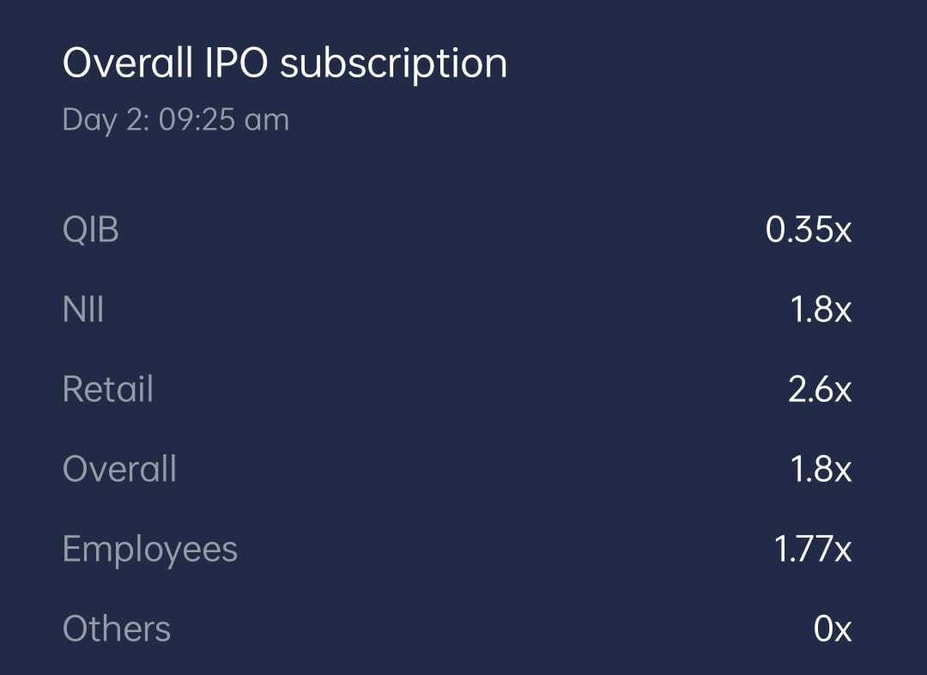

Dharmaj Crop Guard IPO Subscription Status on 29 November

As of 29th November, Dharmaj Crop Guard Limited IPO is subscribed 1.79 times in total. In the retail category, the public issue was subscribed 2.60 times its size. Thus, it is safe to say that investors are showing great interest in this IPO and it may produce decent gains for its shareholders on its listing.

Dharmaj IPO Overall Subscription: Retail Investors, Institutional Investors, Non-institutional Investors & Employees

The subscription status of any IPO helps determine whether an IPO has higher or lower demand. And, as the basic economic rule suggests, the higher the demand, the higher the price, and vice versa.

Dharmaj Crop Guard Ltd. IPO Objectives: Company’s Plans for Future

Here are the basic objectives of Dharmaj Ltd. for its IPO issue:

Dharmaj Crop Guard plans on setting up a manufacturing unit at Saykha, Gujrat. If successful, the investors’ money from the IPO issue would be used partially for the same.

Capital funding for the company.

Repayment of some debts of the firm.

Day-to-day general transactions and business activities.

For all these purposes, Dharmaj plans on raising a capital of at least Rs 216 from the share market.

Dharmaj Crop Guard Ltd. IPO Review: Should You Buy Dharmaj’s IPO?

Trust me, buying or investing in a company or its IPO is not an answer that you should look up on the internet. Yeah, you may find many experts here to answer such questions, but at the end of the day, you are the only one who has to make that decision, right? Try and look for all the data available on the internet that can give you a fair idea of Dharmaj, its way of working, and its current situation. If everything adds up and seems fair, then you may consider applying for Dharmaj’s IPO.

Though, we can still help you in looking for more data about the company and its issue. Here at DesiDime, the dimers’ community is always up to help you with all of your doubts. So make sure to drop down your questions in the comments section below and we will try and help you in the best possible way.

For more information about Dharmaj Crop Guard Limited and its financials, check out its Red Herring Prospectus by SEBI.

Last Updated on: 29th November

Last but not least, if you are new to the stock market and plan on starting your investing journey, you can try using the Paytm Money app for iOS or Android. Also, if you use other stock trading apps like Zerodha or Upstox, we have some great offers and discounts for you:

Follow Us

Follow Us

If GMP is 42 who will apply for IPO price of 216.