- 908 Views

- 4 Comments

- Last comment

12 Comments

|

4 Dimers

- Sort By

https://www.desidime.com/news/how-to-file-87a-rebate-via-income-tax-website-online-before-jan-15th?post_id=10603778#post_10603778

pbcmehul

Link Copied

What for those who have already claimed & demand notice received . ???

https://www.desidime.com/news/how-to-file-87a-rebate-via-income-tax-website-online-before-jan-15th?post_id=10603796#post_10603796

File a revised ITR with 87A tax rebate claim and get the demand reduced to Nil, if the demand is not yet paid?

View 3

more replies

https://www.desidime.com/news/how-to-file-87a-rebate-via-income-tax-website-online-before-jan-15th?post_id=10604005#post_10604005

Yes most likely, this is why the Bombay High Court has given the option to revise 87A rebate before 15th Jan 2025

View 3

more replies

https://www.desidime.com/news/how-to-file-87a-rebate-via-income-tax-website-online-before-jan-15th?post_id=10609778#post_10609778

If already paid Outstanding Demand (Regular Assessment Tax) (400)? how to claim refund?,

Now allow edit in online portal but how to menson already tax paid details in ITR-2?

https://www.desidime.com/news/how-to-file-87a-rebate-via-income-tax-website-online-before-jan-15th?post_id=10649149#post_10649149

thanks the detailed info!!

https://www.desidime.com/news/how-to-file-87a-rebate-via-income-tax-website-online-before-jan-15th?post_id=10761931#post_10761931

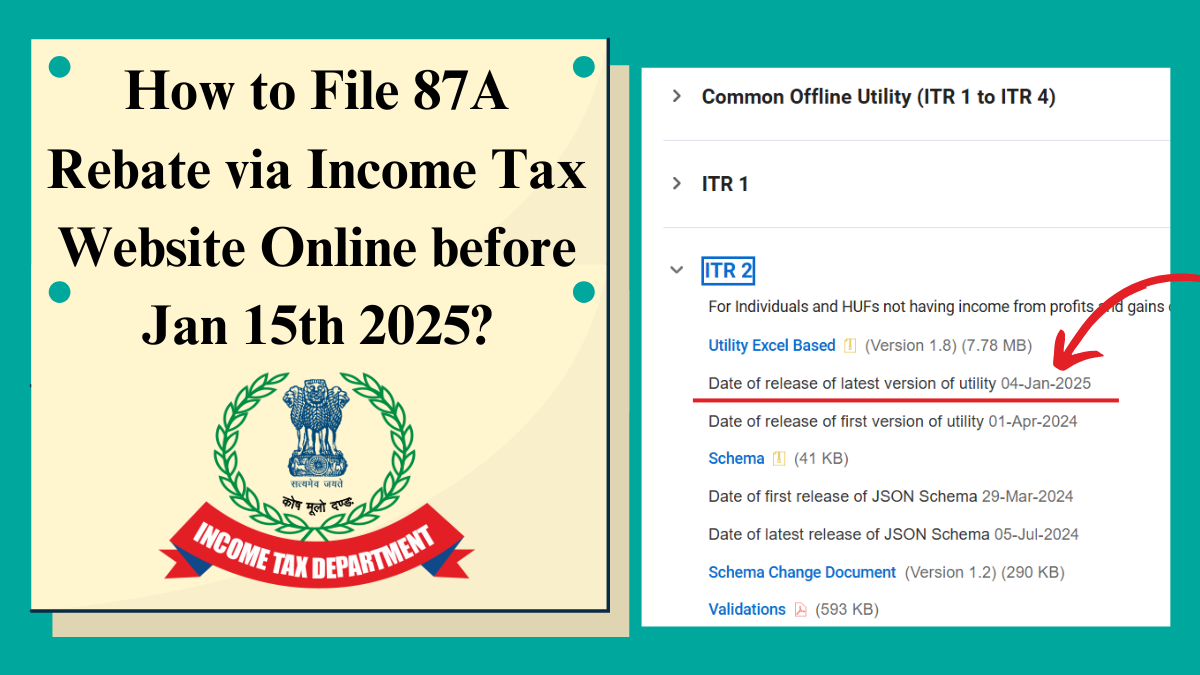

To file the 87A rebate online before Jan 15th, log in to the Income Tax e-filing portal, select the appropriate ITR form, enter income details, claim the rebate under Section 87A, verify tax calculations, and submit. Ensure e-verification via AADHAAR OTP or net banking for a hassle-free process.

Click here to reply

Follow Us

Follow Us