Can’t figure out how to link Aadhaar to PAN online or via SMS? Don’t worry, you’re not alone in this. The Government of India made it compulsory for the citizens of India to link their Aadhaar cards to their PAN cards failing which, they may face trouble with their PAN cards and the related bank and Demat accounts. As horrible as this may sound, linking your PAN card with Aadhaar card is a piece of cake. Though, the PAN-Aadhaar link process will now cost you a penalty of ₹1,000. So, in this article, we will show you how to link your PAN card to Aadhaar card online, and via SMS with a few easy steps.

Note: This process of linking your Aadhaar card with PAN card is mandatory only for those citizens who got their PAN cards made before July 2017. Because after the said date, all PAN cards came being linked with Aadhaar cards already.

The GOI earlier asked the citizens to link their two IDs by March 2022, which was not possible for many. Later, we luckily got an extension for linking our Aadhaar and PAN cards till 31 March 2023. But, this time around, you will have to pay a penalty amount of Rs 1,000 for the process. So if you need to know how to link Aadhaar to PAN with fine, you are at the right place. Let’s get started!

How to Link Aadhaar to PAN Card Online with Fine?

Linking your Aadhaar card to PAN card online is a simple process. The more concerning factor for many people would be that ₹1,000 fine which was ₹500 till last year. In India, we believe that we shouldn’t do something as long as it doesn’t benefit us or isn’t compulsory, yup…we all can agree to that. And, this Aadhaar to PAN linking process is exactly ‘that’ moment when you have to do something, there’s no other option. If you do not get your Aadhaar and PAN card linked by 31 March, according to the Government of India, you will not be able to carry out any financial transactions via your bank account(s). So, let’s see how you can link your Aadhaar card to PAN card online easily.

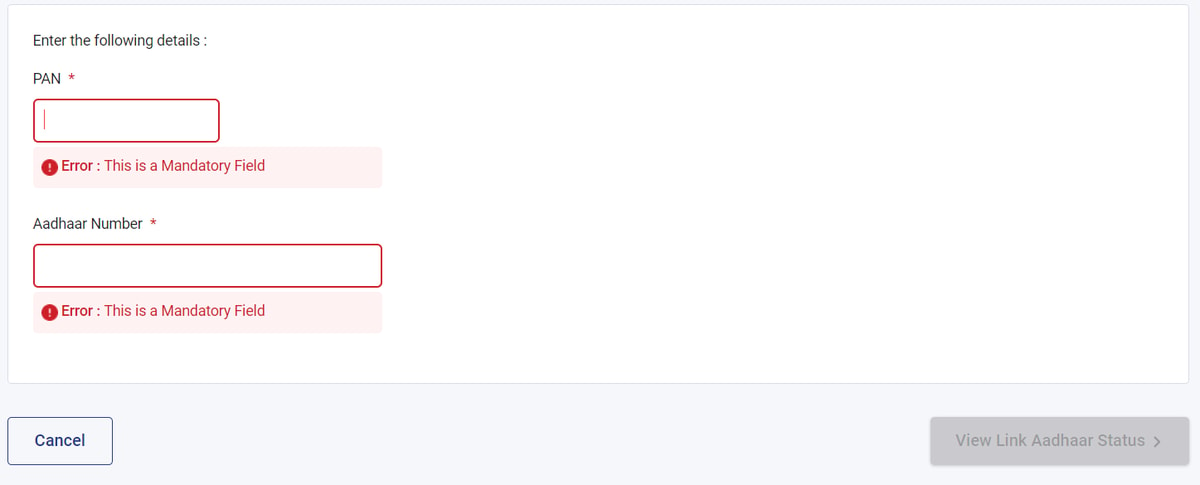

Check if Aadhaar is Linked to PAN or Not

The first step is the easiest and kind of reassuring for many. You just have to check if your Aadhaar card is already linked to your PAN card or not. If yes, then you don’t have to worry about anything. And, if for some reason you didn’t get your PAN and Aadhaar linked, then you will have to go through a bit of trouble. Checking your Aadhaar to PAN link is quite simple, you just have to follow the steps given below:

-

Visit the Income Tax Portal for checking Aadhaar and PAN card link.

There, enter your PAN card number in the box that says ‘PAN’.

Next, enter your Aadhaar card number (without spaces) in the box that says ‘Aadhaar Number’.

Lastly, hit the ‘View Link Aadhaar Status’ button.

-

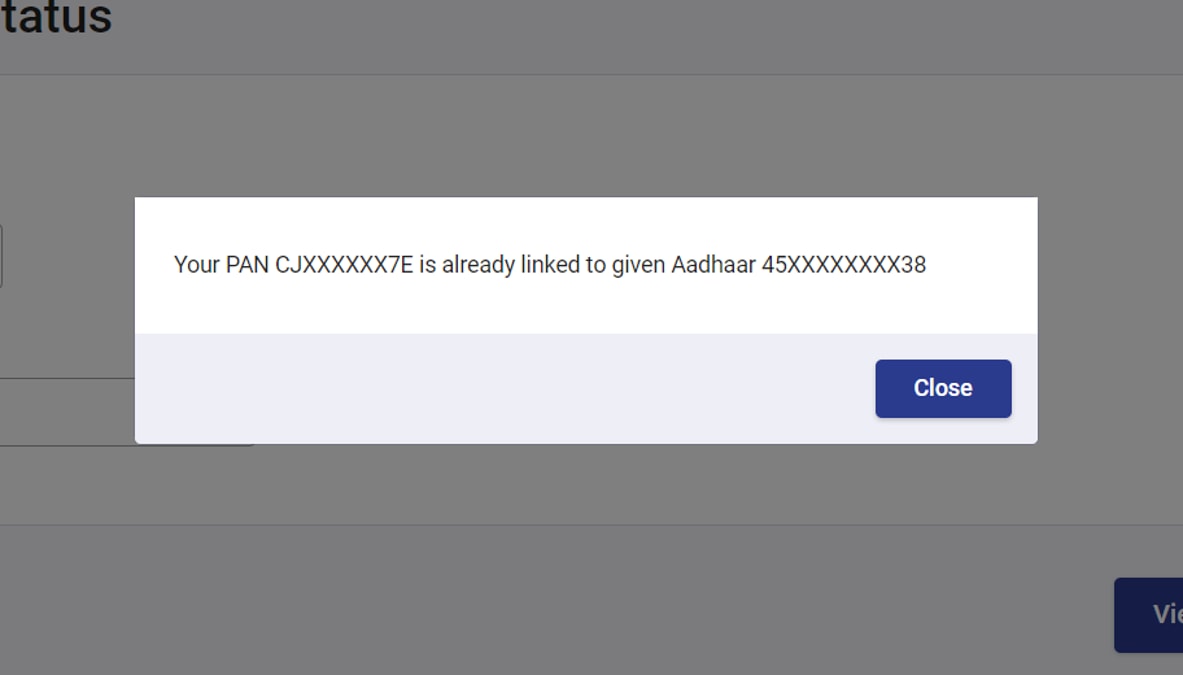

If your Aadhaar and PAN cards are linked, you will see a popup saying “Your PAN XXXXXX is already linked to given Aadhaar XXXXXX”.

-

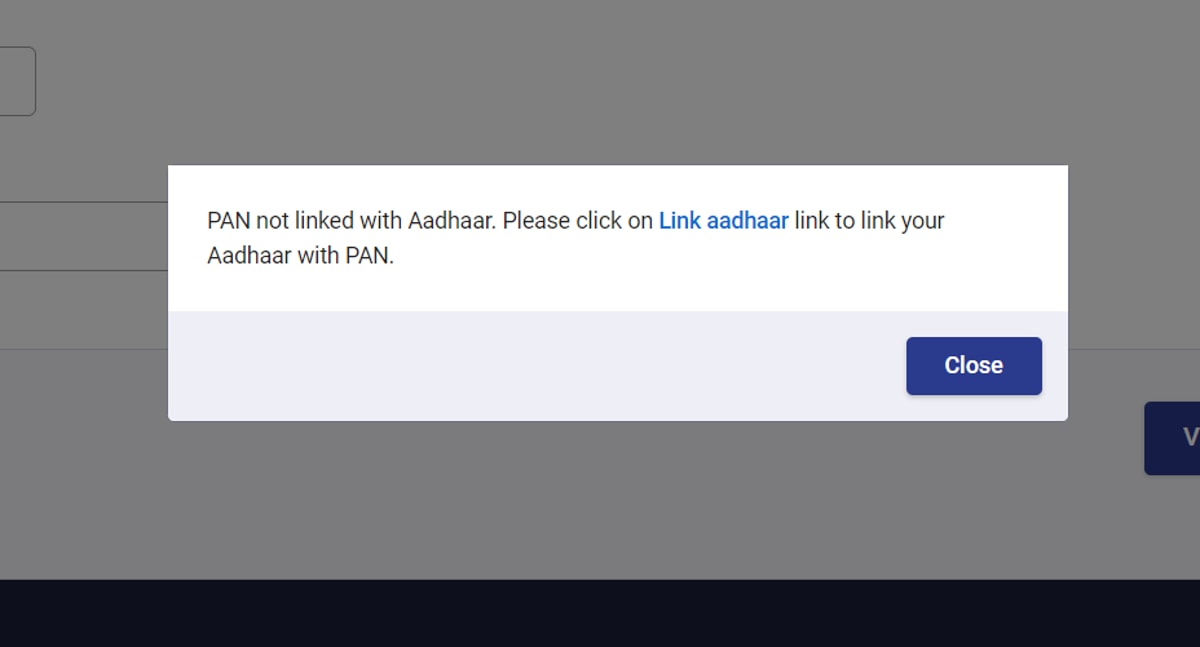

Just sit back and relax, you are safe! But if your Aadhaar card is not linked to your PAN card, the popup will say “PAN not linked with Aadhaar. Please click on Link aadhaar link to link your Aadhaar with PAN”.

Now before proceeding, you need to pay a ₹1,000 fine for linking your Aadhaar and PAN cards. Let’s take a look at it in the next section.

How to Pay the Aadhaar PAN Link Fine?

Now that we know that your Aadhaar and PAN cards are not linked, you will have to pay a fine of ₹1,000. Follow these steps to pay your Aadhaar to PAN link fee:

-

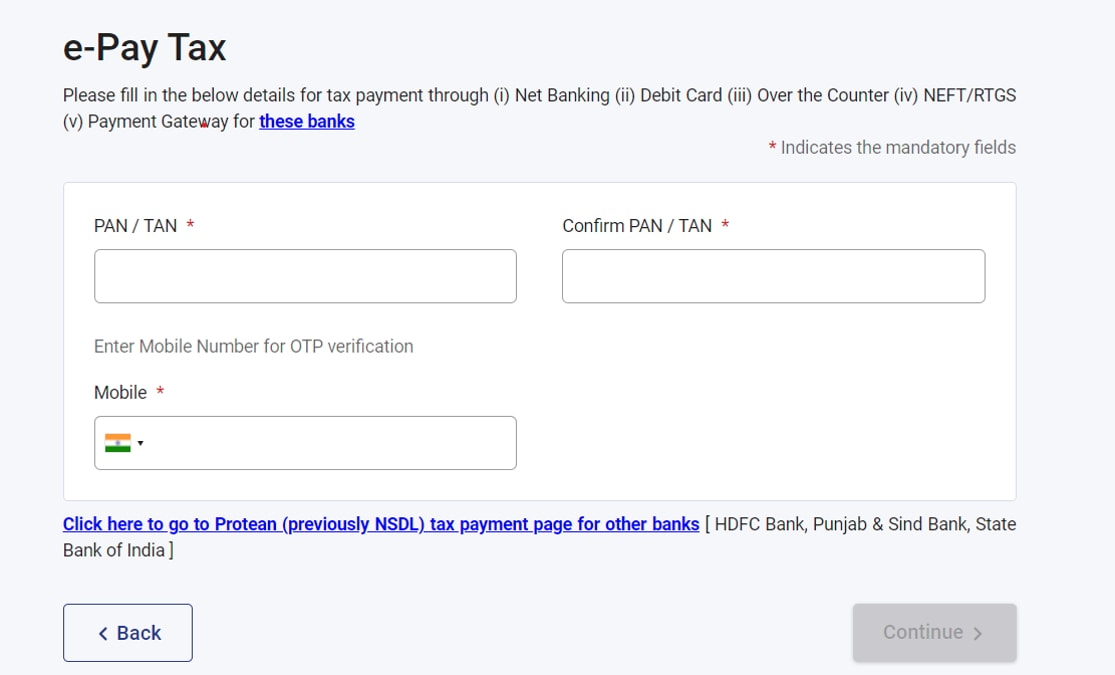

Visit the e-Pay Tax Portal.

Enter your PAN card number in the ‘PAN/TAN’ box.

Confirm your PAN card number by entering it again in the ‘Confirm PAN/TAN’ box.

Enter your mobile number, and hit ‘Continue’.

Follow the on-screen instructions and pay an amount of Rs 1,000.

The above-mentioned payment method for the Aadhaar to PAN link process will work for these banks- Axis Bank, Bank of Baroda, Bank of India, Bank of Maharashtra, Canara Bank, Central Bank of India, City Union Bank, Federal Bank, ICICI Bank, IDBI Bank, Indian Bank, Indian Overseas Bank, IndusInd Bank, Jammu & Kashmir Bank, Karur Vyasa, Kotak Mahindra Bank, Punjab National Bank, UCO Bank, Union Bank of India.

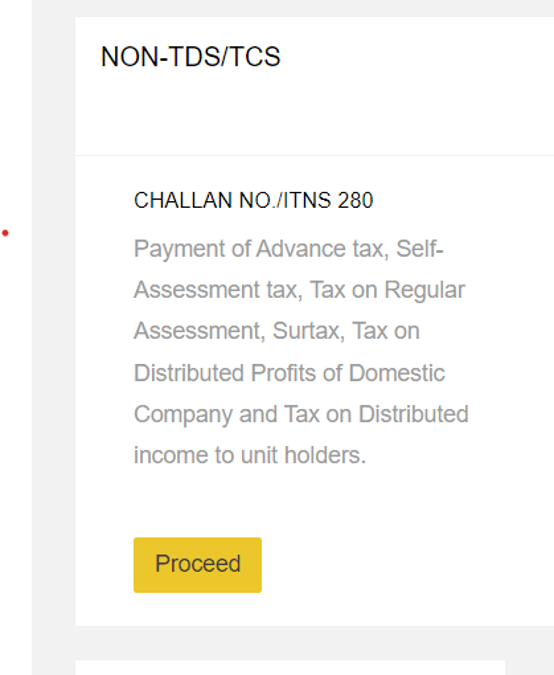

If you have a bank account in some other banks than the ones that are mentioned above, simply visit NSDL and click ‘Proceed’ for the ‘CHALLAN NO./ITNS 280’ tile. Then, you just have to follow the given instructions to pay the fee for linking your Aadhaar card to your PAN card.

Link PAN with Aadhaar Card Online

The final step to link PAN to Aadhaar is really easy after you pay the fine. If you paid the Aadhaar to PAN link fee via NSDL (Protean), you will have to wait for 4-5 working days to try linking these two cards again. If you paid your penalty of ₹1,000 directly from the e-Pay Tax portal, continue with the steps given below:

-

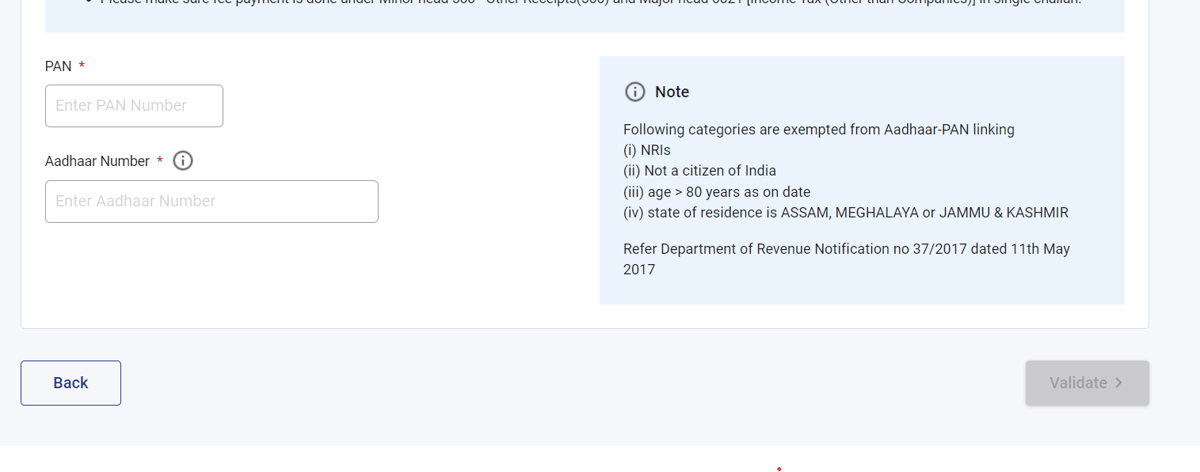

Visit Link Aadhaar (link given above too).

Enter your PAN card number in the box labeled as ‘PAN’.

Fill in your Aadhaar card number in the box that says ‘Aadhaar Number’.

Select ‘Validate’.

That’s it! Your Aadhaar and PAN cards will be linked now and you won’t have to worry about your PAN number being blocked even after 31 Dec 2025.

How to Link Aadhaar to PAN Offline Via SMS?

Now before we go on with the steps to link your Aadhaar card to PAN card offline, let me tell you that this process, on your mobile phone, still isn’t completely offline. You would still need to pay that penalty of Rs 1,000 following the steps that were mentioned in the previous sections and after that, you can link your Aadhaar and PAN offline. So, to link your Aadhaar with PAN offline via SMS, all you have to do is send an SMS to either ‘567678’ or ‘56161’. What would that SMS be? Here it is– ‘UID PAN(SPACE)AADHAAR NUMBER(SPACE)PAN CARD NUMBER’.

Make sure that you enter your Aadhaar and PAN card numbers instead of ‘AADHAaR NUMBER’ and ‘PAN CARD NUMBER’ respectively in the SMS. This will let you link your Aadhaar and PAN cards offline instantly. Now, let’s take a look at some commonly asked questions about this process of linking one’s Aadhaar card to his/her PAN card.

How Can I Link My Aadhaar with PAN Online?

Linking your Aadhaar with PAN card is really simple. You just have to visit the e-filing portal to link both of your IDs and you will be good to go. But hey, do not forget about that late penalty of ₹1,000.

How Do I Know if Aadhaar is Linked to PAN?

To check whether your Aadhaar is linked to your PAN or not, you need to visit the Link Aadhaar Status Portal and follow the steps that we have explained above.

Can we Link Aadhaar to PAN on Mobile?

Absolutely, yes! Linking your Aadhaar and PAN on mobile is really easy and we have explained both, online and offline methods for the same right here.

What is the Last Date of Aadhaar PAN Link?

The last date of Aadhaar PAN link is 31 Dec 2025. After that, your PAN card may not be fully functional, which means that many of its functions will either stop or give you troubles in other ways. So if you haven’t already, hurry up and link your Aadhaar to PAN card!

This is all there is to link Aadhaar card to PAN card. Isn’t it too easy? But even so, if you feel stuck anywhere in the process, do let us know in the comments section and we will help you in the best possible manner. Also, there are rumors that after 31 March, the Government will charge a fine of ₹5,000 for linking Aadhaar to PAN, is it true? What do you think about it?

Special thanks to @third.i.financial.advisors for helping all dimers so well.

Follow Us

Follow Us

![[List] Flipkart Upcoming Sales 2026 with Sale Dates, Timings & Offers](https://cdn0.desidime.com/topics/photos/2073408/medium/ListFlipkartUpcomingSales2026.png?1770376169)

@MrKool_JJ After the deadline any pan not linked with aadhaar will be deactivated unless the person comes under excluded category for this rule(exclusions already given above). If pan was applied only on the basis of aadhaar then most likely it is already linked but still check.