Any reason for not linking?

is not it better to apply for new pan card

The questions to be asked are:

WHAT WILL I GET AFTER LINKING?

WHY IS THERE A FINE EVEN?

SUPREME COURT HAS SAID ITS NOT MANDATORY

This date has no meaning like all previous deadline.

Bottomline: DO NOT FALL FOR THIS.

The Supreme Court of India has already that those citizens who would get Aadhaar cards or PAN cards after July 2017 will have to give their mobile numbers to get both IDs linked together. The court also made it mandatory for everyone to link their Aadhar cards with their PAN cards if they had made them before 2017. For those who didn't have an Aadhar card back then or didn't want to get one, this rule may not apply. Check HERE for more details.

I request you to double verify this before posting in open (even if copied from any website) as they are as bogus as the rest of the media clowns are doing!

// If you do not get your Aadhaar and PAN card linked by 31 March, according to the Government of India, you will not be able to carry out any financial transactions via your bank account(s). //

Even, I've received similar threatening communication from my bank to link before the due date (not the first time though) but none of these kind like restricting ALL financial txns. There shall be limits/ restrictions as they are threatening to cease the PAN cards too.

Do cross check the same with the last Gujarat HC order to not ask for any link until the case is settled in SC (NewsLink) which is due since a long long time, hence these list of all these deadlines. Might get extended this time too, who knows!

But, please take care while posting on some sensitive topics (sub-judicial ones) that gives threatening directives in the current scenario (even if copied from the source) as the consequences are very very serious for the misinformation being spread by us to a larger scale and here GoI itself is not clear about the guidelines nor the RBI, it seems. They have many conflicts of statements between them in the past.. now also and all these can be cleared once, after this is settled in the court of law for real.

Till then idiocy rules!

inoperative PAN is a complicated thing technically u can still transact with limited manner with a 'inoperative PAN' with ur bank account, it'll act like an account made without PAN, banks will deduct 20% TDS on those accounts, problem will arise in trading/demat account as those can't be operated without PAN so who knows what's gonna happen

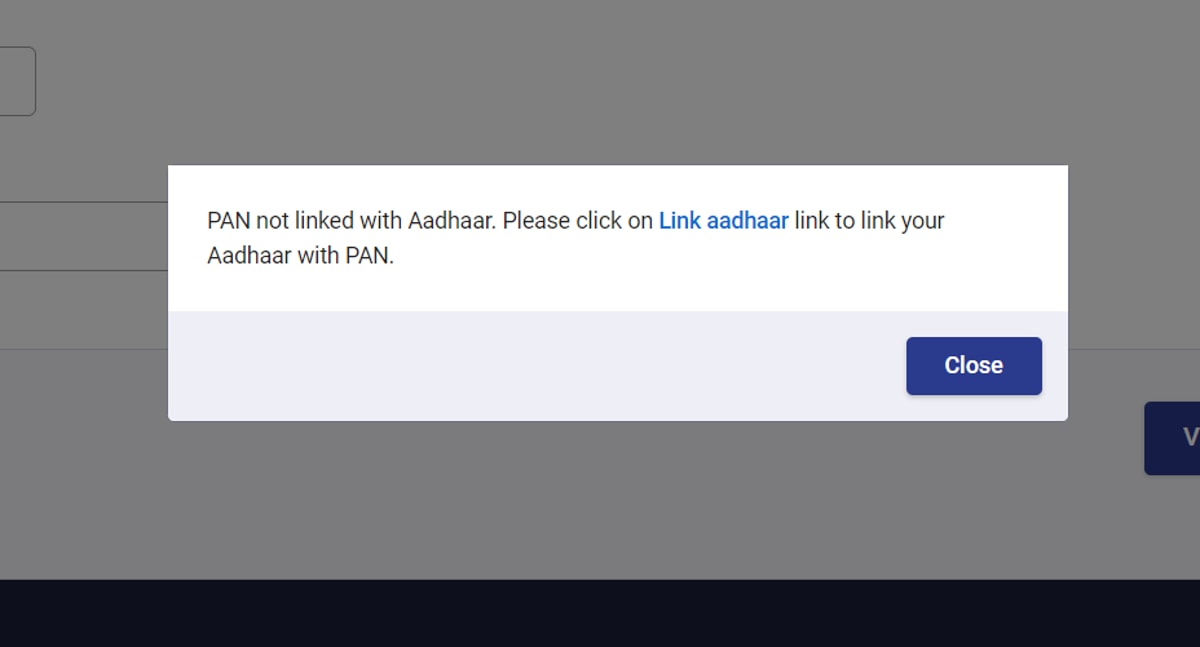

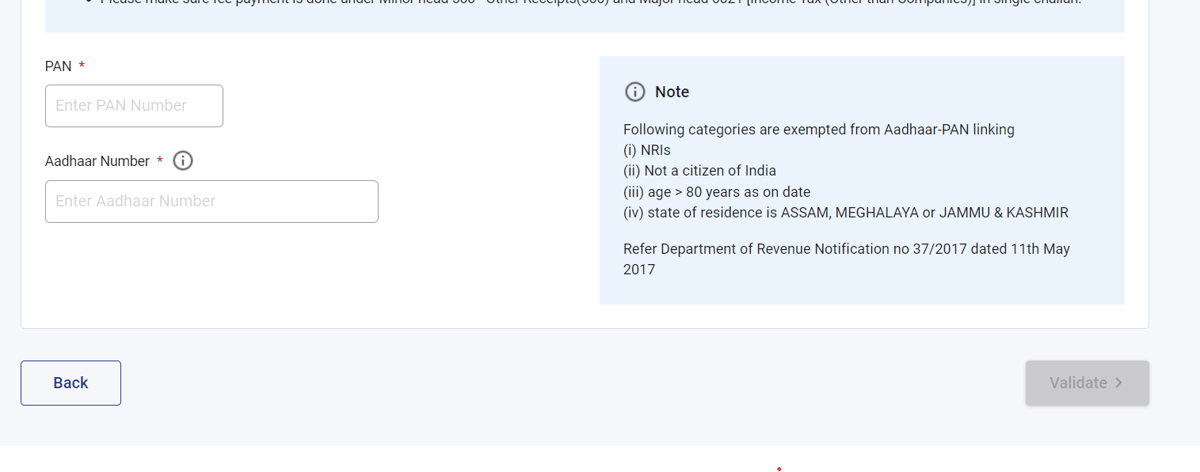

The main reason many have not linked their PAN and Aadhaar is that any slight mismatch in their names can prevent them from being linked. First, they need to correct their names and then apply, but this name change procedure can also be cumbersome.

The future is very dark for India when indian slaves are themselves asking for their chains and even paying for them. Wake up and at least now understand the real plans behind Aadhaar. It's already late!

Don't link it, don't use it dont produce it anywhere! This may be your last chance.

They have to extend as they are forcing it unconstitutionally. Even African courts have thrown out such dystopian ID systems (like Hudumanamba in Kenya). But our openly courts serve this colonial power.

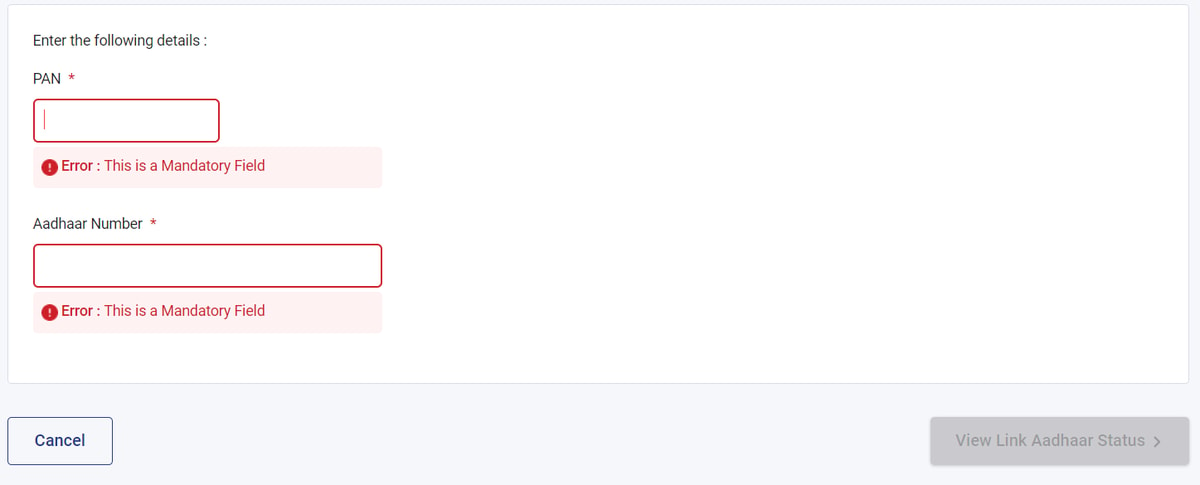

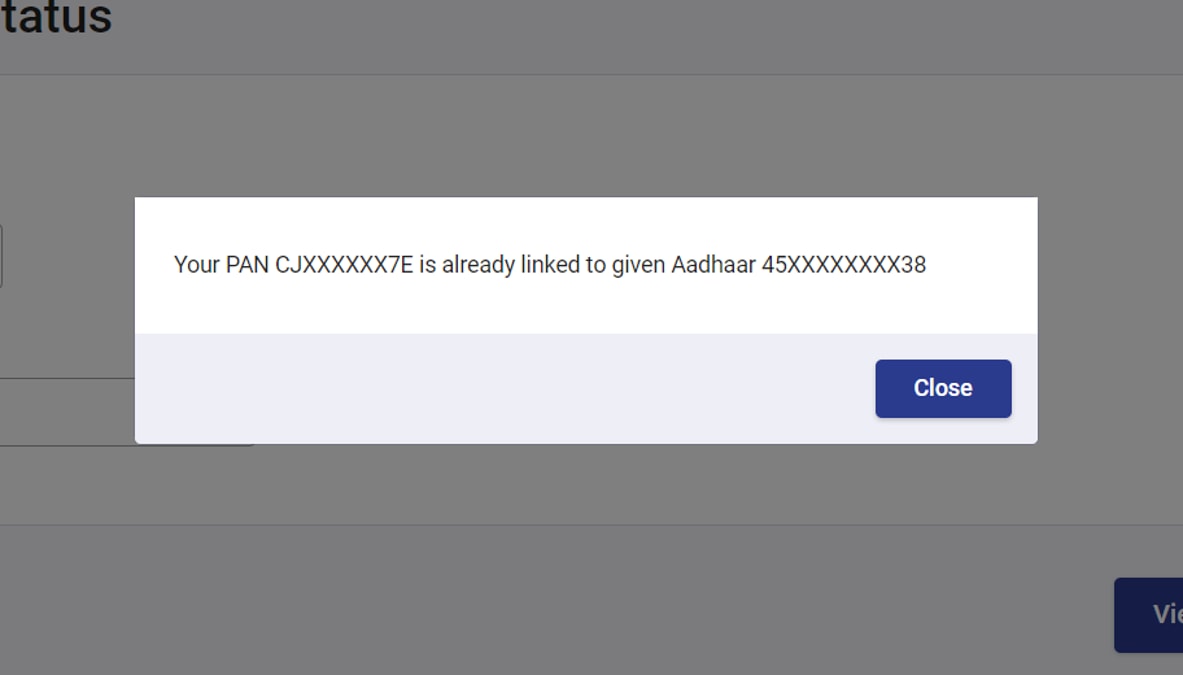

Any solution for this error?

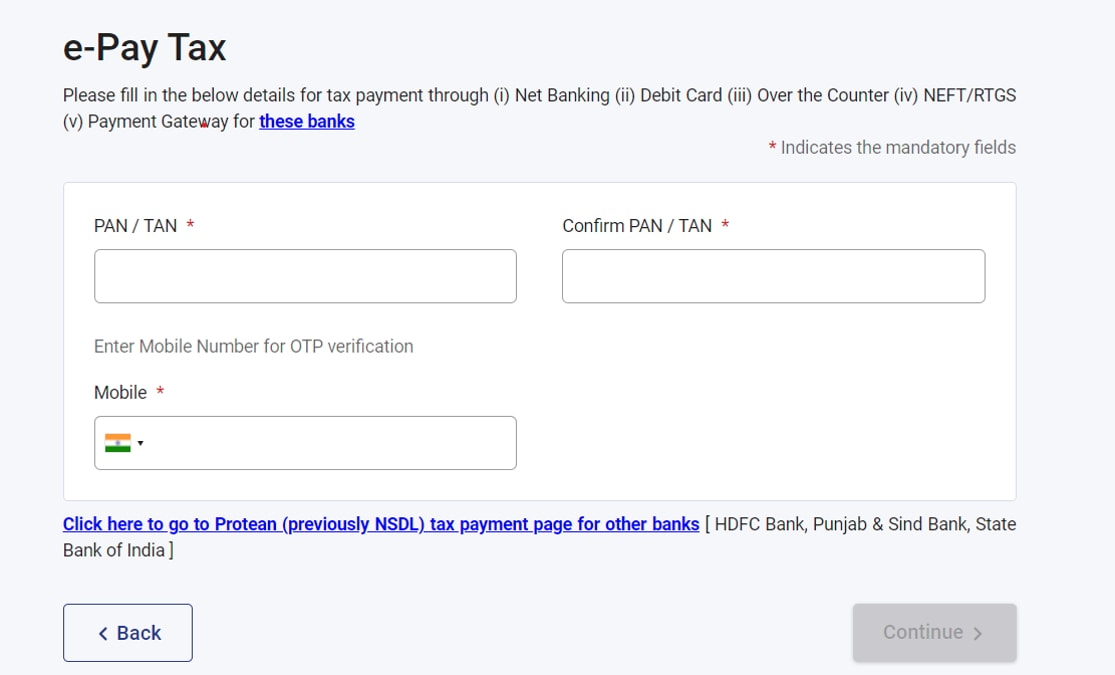

Any solution for this error?Been trying to pay the 1k.. for 3 days now.. every time this error pops up and the payment fails..

@Sahil_Jain

There are times when these problems are associated with a particular device that you are using or with a bank. If possible, try paying the fee with another device/bank account. If that doesn't work, try visiting an Aadhaar card agent near your place. They generally get the job done easily and may charge a nominal fee (hardly around Rs 50). Not saying that you should go to them right away, but if all other ways fail, this might be your last option. Also, if they are unable to help you too, then you don't have to pay them and then you can visit an Aadhaar center near you.

PS: There are two different methods to pay this fine for different bank accounts. Did you check the list mentioned in the post?

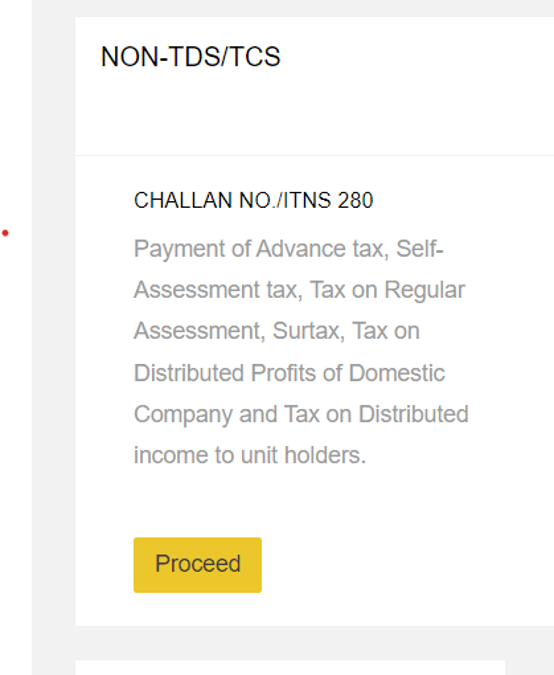

If anyone has a problem doing this .... as per the detailed procedure given above .. pls pm me .... . THE PROCESS IS NOT DIFFICULT BUT MAKE SURE OF DATES AND ASSESSMENT YEAR. IF YOU PUT IN A DIFFERENT HEAD, YOU WONT GET CREDIT AND 1000 RS WILL BE EASILY LOST.

TAKE CARE OF HEAD , ASSESSMENT YEAR AND TYPE OF PERSON. RE VERIFY IT . ONLY THEN PAY. ONE SMALL MISTAKE MIGHT COST YOU 1000 RS EXTRA !

I have already paid challan, but names mismatch in PAN and Aadhar..

So, placed a request to change name in PAN..

Currently that is in pending status.

What happen if pan card name is not updated till March 31st and existing challan would be applicable after March 31st also?

Great if it gets done within 31st march, else the 1000 rs cant be claimed back as the AY changes.

Will the bank account associated with the PAN get frozen on grounds of KYC if PAN becomes inoperative? My mother's PAN is not linked but she does not have any use for it either (she's a housewife) so I don't see any benefit of linking. I do however have an FD in her bank account so I'm wondering what happens if PAN becomes inoperative.

.

The Fine was implemented from Jun - 2022, Before Rs. 500/- was Fine & Now it is Rs. 1000/-, Everyone was checked from Income Tax Portal, but Koi Bolta Nahi tha, now the Penalties are Heavier then everybody Shouting.

Try to Understand the Matter first

Anyone tried with SMS Method?

Need format again as in the thread mentioned but it's confusing

Which option we need to choose and pay 1000?

Which option we need to choose and pay 1000?Does payment need to pay via same pan holder bank account?

Anyone can pay right.

https://pib.gov.in/PressReleasePage.aspx?PRID=1....

@Sahil_Jain bro please update if possible

My father had 2 pan on his name and he surrender his the wring one 3 years back but we had connected the aadhaar to the wrong and now we want to rectify the connection of wrong Pan with the aadhaar. How to do that?

Now some people crying really

& some people faking it they have already link card but to comment on bjp they are commenting like as if they are really paying

Govt asking to link from 2018 and it takes hardly 2 minutes but still people not did it

Around me people I seeing educated not linked but uneducated link wayback

in short If I was FM i would imposed minimum 10K

Follow Us

Follow Us

![[List] Flipkart Upcoming Sales 2026 with Sale Dates, Timings & Offers](https://cdn1.desidime.com/topics/photos/2073408/medium/ListFlipkartUpcomingSales2026.png?1770376169)

Fine of 1000rs is too much for a common man like me to pay 🤧.afterall we are safe from Pakistan only ...