Latest Best Credit Card Offers

HDFC Pixel Go Rupay Credit Card

0

₹250+tax (LTF is Limited Period Offer for HDFC customers)

₹upto 10% Cashback

- Salaried Individuals:

- Age: 21 to 60 years

- Gross Monthly Income: Above ₹8,000

- Self-Employed Individuals:

- Age: 21 to 65 years

- Income Tax Return (ITR): Over ₹6 lakh per annum

- Salaried Individuals:

HDFC Pixel Play Rupay Credit Card

0

₹500+tax (LTF is Limited Period Offer for HDFC customers)

₹upto 10% Cashback

The HDFC Bank PIXEL Play Credit Card is a digital credit card designed for individuals who prefer managing their finances through mobile applications. It offers customizable benefits, allowing cardholders to select rewards that align with their spending habits.

Key Features:

- Customizable Cashback:

- 5% Cashback: Choose any two brand packs from the following categories:

- Dining & Entertainment: BookMyShow, Zomato

- Travel: MakeMyTrip, Uber

- Grocery: Blinkit, Reliance Smart Bazaar

- Electronics: Croma, Reliance Digital

- Fashion: Nykaa, Myntra

- 3% Cashback: On one selected e-commerce merchant: Amazon, Flipkart, or PayZapp

- 1% Cashback: Unlimited cashback on all other spends

- 1% Cashback on UPI Spends: Applicable only for PIXEL RuPay Credit Card holders

- 10% Cashback on Dining Spends Via PIXEL RuPay Credit Card UPI Scan & Pay

- 5% Cashback: Choose any two brand packs from the following categories:

- Digital Management via PayZapp App:

- Instant digital card issuance

- Manage card controls, rewards, EMI conversions, statements, repayments, and more

- Pay in Parts:

- Convert outstanding balances into EMIs with flexible tenures

- Manage EMIs through the PayZapp app

- Additional Benefits:

- Dining Privileges: Up to 25% savings on restaurant bills via Swiggy Dineout

- Fuel Surcharge Waiver: 1% waiver on fuel transactions between ₹400 and ₹5,000 (maximum waiver of ₹250 per statement cycle)

- Contactless Payments: Supports Tap & Pay and Scan & Pay features

Fees and Charges:

- Lifetime Free: Limited Period Offer for HDFC Bank customers

- Joining Fee: ₹500 (waived on spending ₹20,000 within the first 90 days)

- Annual Fee: ₹500 (waived on annual spends of ₹1 lakh or more)

How to Apply:

- Download or update the PayZapp app from the Google Play Store or Apple App Store.

- Click on the "Apply Now for PIXEL Play" banner on the PayZapp homepage.

- Customizable Cashback:

- Age: 21 to 60 years

- Income:

- Salaried Individuals: Minimum monthly income of ₹25,000

- Self-Employed Individuals: Minimum annual income of ₹6 lakhs

CASHBACK SBI Card

999

999

₹5% Cashback on online spends without any merchant restriction

The CASHBACK SBI Card is worthy if your online shopping spends are high because you will earn cashback which can be used on next transactions.

- 5% Cashback on online spends without any merchant restriction

- 1% Cashback on offline spends

- Card Cashback will be auto-credited to your SBI Card account within two working days of your next statement generation

- Reversal of Renewal Fee on annual spends of Rs.2 Lakh

- 1% Fuel Surcharge Waiver across all petrol pumps in India*

- Joining Fee (one-time): Rs. 999

- Renewal Fee (Per Annum): Rs. 999 from second year onwards. Renewal Fee reversed if annual spends for last year >= Rs. 2,00,000.

- Cashback not applicable on Merchant EMI & Flexipay EMI transactions and on following categories: Utility, Insurance, Fuel, Rent, Wallet, School & Educational Services, Jewelry, Railways etc.

- You can use your CASHBACK SBI Card in over 24 million outlets across the globe, including 3,25,000 outlets in India

- Pay your electricity, telephone, mobile and other utility bills using the Easy Bill Pay facility on your CASHBACK SBI Card

- Transfer the outstanding balance of other banks’ credit cards to your CASHBACK SBI Card, and avail a lower rate of interest and pay back in EMIs

Minimum Age – 21 years

Maximum Age – 70 years

Occupation – Salaried or Self-Employed

Other Criteria – Regular source of Income, Good credit score, etc.

Swiggy HDFC Bank Credit Card

500

500

₹10% Cashback on Swiggy, 5% on Online Spends

The Swiggy HDFC Bank Credit Card is a cashback reward card specially for Swiggy orders. It has got normal credit card benefits as well. If you are a food lover then this card is for you! It promises up to ₹42,000 savings per year! For instance, on a monthly basis if you spend ₹5000 on Swiggy (food & beverages, groceries, personal care, essentials), ₹3000 on online platforms, and ₹4000 offline then you will get ₹8,280 cashback in a year.

Swiggy HDFC Bank Credit Card Benefits

- 10% cashback (Up to Rs 1500 per month) on Swiggy spends (Across ordering food, dining out, groceries and more) in addition to the regular offers & discounts!

- 5% cashback (Up to Rs 1500 cashback per month) on online spends (BookMyShow, Amazon, Myntra, Ola, Flipkart, etc.)

- 1% cashback (Up to Rs 500 per month) on other spends (offline spends and other food, grocery & dining apps)

- FREE 3 month Swiggy One membership (Enjoy free deliveries & extra discounts on Food, Instamart, DineOut & more) worth ₹1199 Complimentary with Swiggy HDFC Bank credit card (after card activation).

- Premium golf club access worldwide: 12 free golf lessons/year in India

- Free stay & dine: One night & one dines free at select Mastercard partners globally

- Agoda discounts: Up to 12% instant discount on worldwide hotels on Agoda

- Enjoy a wide range of Mastercard World benefits (Gloria Jean's Coffees Maldives, Universal Studios Singapore, Expedia, more) with this card

- Up to 50 days of interest-free period on your Swiggy HDFC Bank Credit Card from the date of purchase

Swiggy HDFC Bank Credit Card Fees and T&Cs

- Joining fee ₹500

- Annual renewal fee ₹500 (waived-off for annual card spends over ₹2 lakhs)

- Cashback exclusions

From any cashback: Rent, Utilities, Fuel, Insurance, EMI, Jewelry, Govt spends, Wallet loads & similar spends

From 5% cashback: Flight, hotel bookings & others - Monthly cashback limit

On 10% cashback spends: ₹1500/month

On 5% cashback spends: ₹1500/month

On 1% cashback spends: ₹500/month

For Salaried Indian national

Age: Min 21 years & Max 60 Years

Net Monthly Income > Rs.15,000

For Self Employed Indian national

Age: Min 21 years & Max 65 Years

ITR > Rs 6 Lakhs per annum

Swiggy HDFC Bank Credit Card FAQs

How will I save via Cashback?

Cashback earnings goes into your Swiggy Money wallet. Thus, you can use it to order Free items from Swiggy. Make a note that each Swiggy Money cashback entry expires after 1 year!

Is Swiggy HDFC card worth it?

It is worth for food enthusiasts and those who order from Swiggy often.

What is the limit of Swiggy HDFC credit card?

The credit limit will be distributed between the HDFC credit cards that you hold. For example, let’s assume

the credit limit on your existing HDFC Bank credit card is 2 lakhs. Upon issuance of Swiggy HDFC Bank Credit Card, the

limit of 2 lakhs will be shared between the 2 credit cards. Supposing, you used credit limit of 1.5 lakhs with your existing

HDFC Bank Card, then only the remaining Rs.50,000 will be left for usage with Swiggy HDFC Bank Credit Card. If you have only the Swiggy HDFC card then the entire Rs 2 Lakh limit can be used on it.Does Swiggy HDFC credit card have lounge access?

No. Also, there is no fuel surcharge waiver.

Can I use credit card in Swiggy?

Yes. The best one to use is the Swiggy HDFC Bank Credit Card with 10% limited cashback every month along with existing Swiggy coupons and offers.

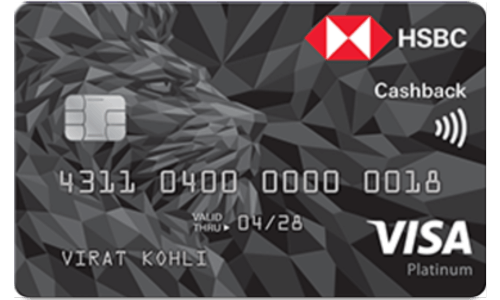

HSBC Cashback Credit Card

999

999

₹1.5% unlimited cashback | 10% accelerated cashback

- 10% accelerated cashback on all dining, food delivery and grocery spends (capped up to INR1,000 per billing cycle)

- 1.5% unlimited cashback on all other spends (exclusions apply)

- 4 complimentary domestic lounge visits per year (1 per quarter)

- Annual membership fees of 999 will be reversed if your total annual spend exceeds 2,00,000

- Buy-one-get-one-free movie tickets on Saturdays (Up to 250) on BookMyShow

- The cashback which is received will be credited to your credit card within 45 days of the card statement date.

- You must be aged between 18 to 65

- Your annual income must be at least INR400,000 per annum (for salaried individuals)

- You must be an Indian resident

- You must reside in any of the following cities: Bangalore, Chennai, Gurgaon, Hyderabad, Mumbai, New Delhi, Noida, Pune

FAQs

Is HSBC cashback card good?

Yes, for unlimited cashback.

Can you get cashback with HSBC?Yes, via HSBC Cashback credit card.

What is HSBC cashback offer?It gives 1% cashback, 1.5% cashback on online spends, and 10% accelerated cashback.

Does HSBC cashback credit card have lounge access?Yes, 2 Airport Lounge Access for domestic and international lounges or 2 meal vouchers worth Rs. 400 at restaurants at the airport.

TATA Neu Infinity HDFC Bank RuPay Credit Card

1500

0

₹5% Cashback as NeuCoins on TATA brands

The TATA Neu Infinity HDFC Bank Credit Card is a better version of the TATA Neu Plus HDFC Bank Credit Card. Launched as a co-branded credit card, the TATA Neu Infinity card also works on the RuPay payment network and offers greater rewards than the Infinity Plus Credit Card, at a higher cost too. With more complimentary Airport Lounge Visits, this credit card is surely better for anyone looking for a good travel credit card too.

- 1.5% NeuCoins as cashback on all spends

- Additional 5% NeuCoins cashback for TATA NeuPass holders

- Get 8 Complimentary Domestic Airport Lounge Access per year

- 1% fuel surcharge waiver

- Get an annual fee waiver by spending ₹3,00,000 or more within a year

- Minimum Age for Salaried Employees: 21 Years

- Maximum Age for Salaried Employees: 60 Years

- Monthly Income for Salaried Employees: More than ₹1,00,000

- Minimum Age for Self-Employed Applicants: 21 Years

- Maximum Age for Self-Employed Applicants: 65 Years

- ITR Annually for Self-Employed Applicants: ₹12,00,000

Is the TATA Neu Infinity Card Worth It?

The TATA Neu Infinity Credit Card can be worth the fee if you find the perfect use for it. By spending a certain amount in a year, you can waive off its annual fee and the benefits that it offers are quite good too, which makes the TATA Neu Infinity HDFC Credit Card worth it.

What is the Yearly Charge for the TATA Neu Credit Cards?

The TATA Neu Plus Credit Card comes with an annual fee of Rs. 499 and the TATA Neu Infinity Credit Card has an annual fee of Rs. 1,499.

What is the Reward Rate of TATA Neu Infinity?

The TATA Neu Infinity Credit Card offers 5% NeuCoins back on all spends on the TATA Neu App. For other spends, the reward rate is 1.5 NeuCoins.

TATA Neu Plus HDFC Bank RuPay Credit Card

500

0

₹2% Cashback as NeuCoins on Tata brands

The TATA Neu Plus HDFC Bank Credit Card is a very promising RuPay credit card that gives a huge number of reward points in the form of NeuCoins, that can be used on the TATA Neu App. It is a complete lifestyle package credit card that comes with numerous benefits and a very minimal charge. As a limited-period offer, you can get the TATA Neu HDFC Bank Credit Card without paying any joining fee.

- 1% NeuCoins as cashback on all spends

- Additional 5% NeuCoins cashback for TATA NeuPass holders

- Get 4 Complimentary Domestic Airport Lounge Access per year

- 1% fuel surcharge waiver

- Get an annual fee waiver by spending ₹1,00,000 or more within a year

- APR: 45%

- Minimum Age for Salaried Employees: 21 Years

- Maximum Age for Salaried Employees: 60 Years

- Monthly Income for Salaried Employees: More than ₹25,000

- Minimum Age for Self-Employed Applicants: 21 Years

- Maximum Age for Self-Employed Applicants: 65 Years

- ITR Annually for Self-Employed Applicants: ₹6,00,000

Is the TATA Neu Plus Credit Card Lifetime Free?

No, the TATA Neu Plus Credit Card is not lifetime free. But, cardholders can get an annual fee waiver by simply spending ₹1,00,000 or more in a year.

What are the Benefits of the TATA Neu Plus Credit Card?

The TATA Neu Plus Credit Card comes with many benefits, including rewards and cashback in the form of NeuCoins that can be used for shopping. It also offers airport lounge access, fuel surcharge waiver, and other benefits to the user.

What is the TATA Neu Plus Credit Card?

The TATA Neu Plus Credit Card is a co-branded credit card launched by HDFC Bank in partnership with the TATA Group.

Amazon Pay ICICI Credit Card

0

42

₹5% & 3% Cashback on Amazon

The Amazon Pay ICICI Credit Card is one of the best lifetime free credit cards out there for online shopping. Rather than giving you some reward points like every other credit card, this LTF credit card from ICICI and Amazon gives you cashback on your online and offline purchases. This not only makes shopping fun but rewarding too. The best part of having a cashback credit card is that you do not have to worry about the hassle of collecting and redeeming reward points before they expire. This is what makes this lifetime free credit card so good. You can check out all the offer details of the Amazon Pay ICICI Credit Card below:

- 2% cashback on payments done to 100+ partner merchants via the Amazon Pay app.

- 1% cashback on all other spends, online and offline.

- Flat ₹200 back on first shopping/bill payment via the Amazon app

- 25% cashback up to ₹200 on shopping on the Amazon app

- 50% cashback up to ₹100 on Prepaid Mobile Recharges

- 25% cashback up to ₹350 on Postpaid Bill Payments

- 20% cashback up to ₹250 on Electricity Bill Payments

- 25% cashback up to ₹250 on DTH recharges

- 25% cashback up to ₹400 on Broadband Bill Payments

- 10% cashback up to ₹150 on Gas Cylinder Payments

- Free EazyDiner Prime membership for 3 months

- 3 Months and 6 Months No Cost EMI on Amazon

- Welcome rewards worth ₹2,000 + 3 months free Amazon Prime Membership

- Minimum Age: 18 Years

- Maximum Age: 60 Years

- Minimum Required Income for Existing ICICI Customers: ₹25,000/month

- Minimum Required Income for Others: ₹35,000/month

The HDFC Bank PIXEL Go RuPay Credit Card is a customizable entry-level credit card designed to offer cashback rewards and flexible payment options. Here are its key features:

Key Features:

Fees and Charges:

Additional Benefits:

Application Process:

To apply for the PIXEL Go Credit Card, download or update the PayZapp app from the Google Play Store or Apple App Store. Within the app, navigate to the homepage and tap the "Apply Now for PIXEL Credit Card" banner to initiate your application.

Note: The PIXEL Go Credit Card is available in both RuPay and Visa variants. The RuPay variant offers additional benefits on UPI transactions.