Also use the Payzapp offer for Nobroker for additional 500rs. cashback

- 908 Views

- 4 Comments

- Last comment

Plz explain the Payzapp offer for Nobroker and Redgiraffe

What abt payzapp

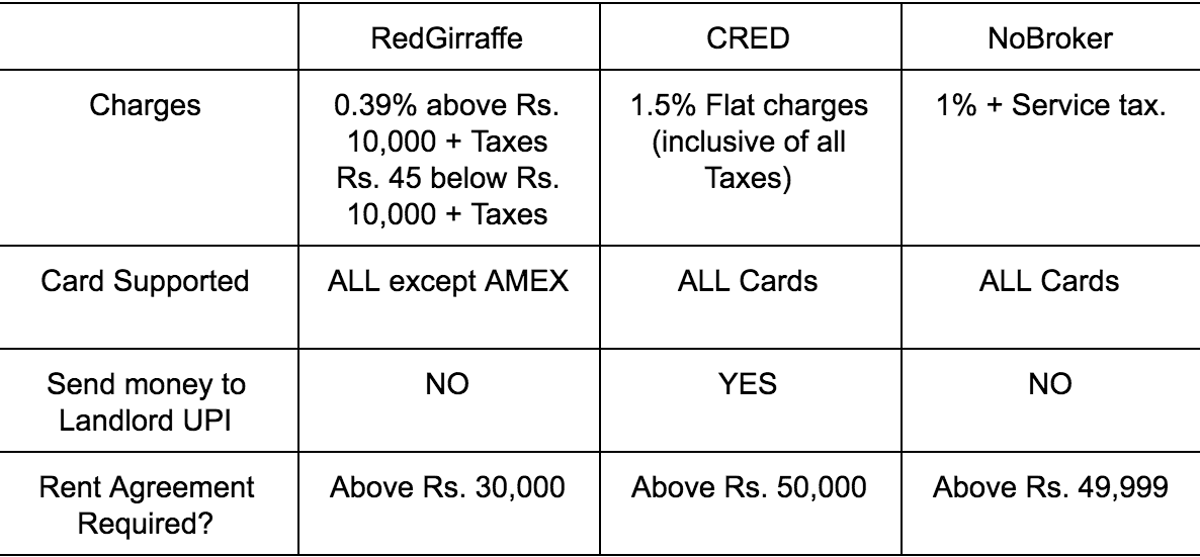

Cred stopped amex payment

Which payment mode u used? PayZapp or Directly Credit card??

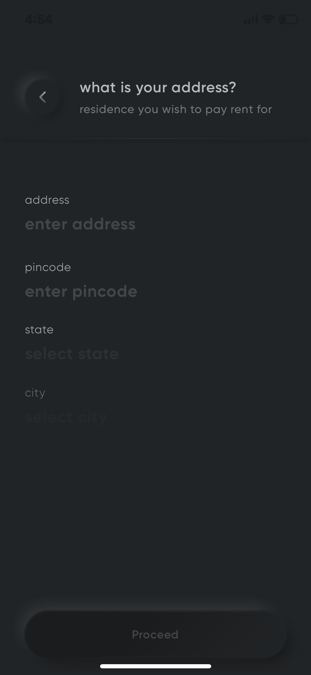

“NoBroker requires rent agreement above Rs. 49,999” @admin

I beleive this is incorrect. They can ask for Rent Agreement anytime, and if not provided they keep your money or put 1/2 percent as their charges.

Note: I think this should be tried only when you have actual rent to be paid, and not to create a CC spend. Once stuck, you may end up loosing money or begging to them.

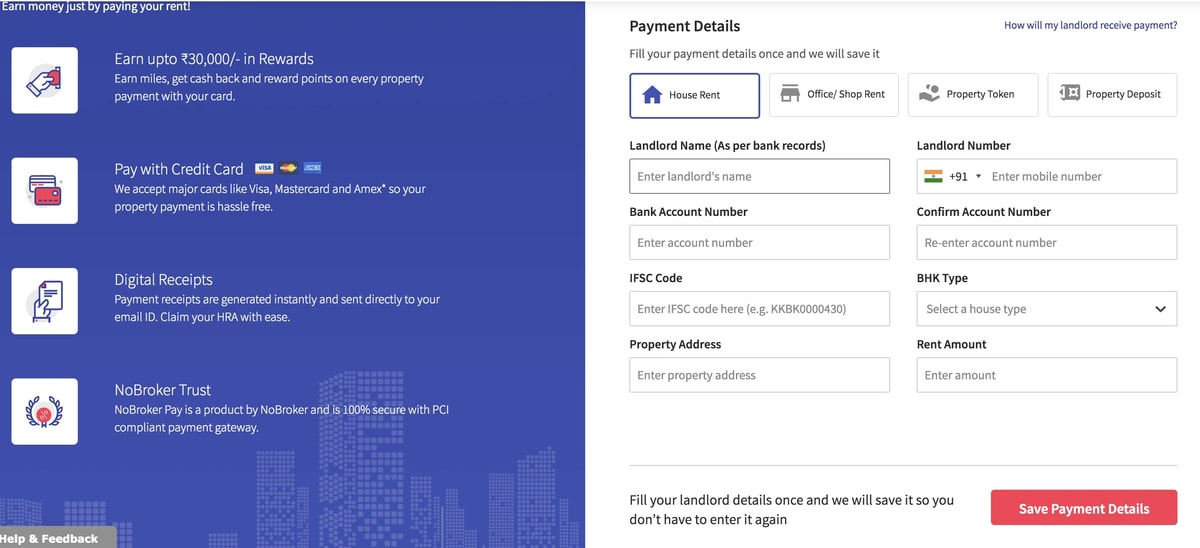

Should add housing.com to the list. Last I checked

- they charge 1.3%

- didn’t ask me for a rental agreement at any stage

- they did a deposit of Rs 1 in my ‘landlords’ account to verify the account

- available only on app (Nobroker & Redgiraffe have a website but couldnt find rent pay link on Housing.com website)

- no experience in actually paying the rent. Was just testing them, so dont know if it gets stuck like Nobroker etc.

Yes, you are right…

I have good experience with housing…

Hay… careful with NoBroker…

if you have some mistakes in agreement or no agreement then you will loose the extra percentage amount plus 2 percent extra.

better Avoid.

Absolutely. NoBroker is utterly useless. Never use it!!

I think DD is now accepting Paid Promotion . Finding 2nd such post.

Add biller redgiraffe in payzapp and use BILLPAY promocode to get extra 200 cb 🙂

This is totally different option and should be first choice, if working. What are extra charges via this option? Will all cc works

Nobroker is fraud….they have written in terms and conditions that WE MAY ASK FOR RENTAL AGREEMENT. it’s better that that should first take agreement and then proceed…why they do like this …first they do the transaction and then forcefully asking for agreement is feeling like cheated…else they should charge some extra

@admin I’m not clear on the returns specified for Amex. The returns on gold and membership rewards card are high upto the 6 or 4 separate transactions for the 1000 bonus rewards and quickly diminish after that.

Could you please clarify?

That’s correct but one can also get complimentary card and avail same benefits.

Give redgiraf referral

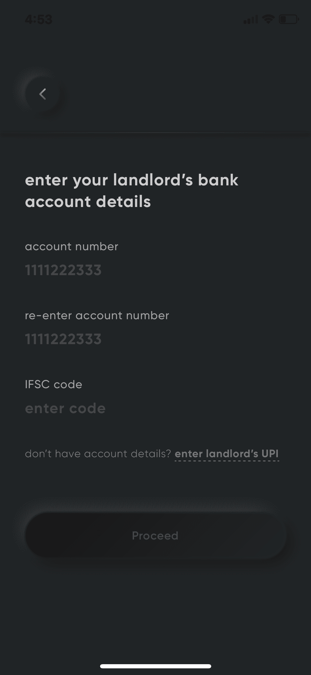

Do we have to provide owner’s pancard in redgiraf?

Use nobroker only if you have agreement. my money also got stuck.

Luckily, I had my last year agreement which I uploaded and after some heated argument with CC, my rent was transferred.

Amount was just 11.5k and yet they want agreement.

I think they are asking from everyone who is using payzapp.

I’ll never use no broker again.

Which payment mode u used? PayZapp or Directly Credit card??

One more addition and correction to the table above:

Nobroker charges 2% above Rs 49,999.

Also a correction in the table Nobroker charges flat 1%. Your table has it listed as 1% + GST.

How do you register on Redgiraffe without rent agreement? I see no option on the site to register without uploading rent agreement.

I think who used the PayZapp Offer they asked the rent agreement for those .

Any one Face this issue with direct credit card payment???

I’m using No broker since past 3 months with payzapp, so far no issues, no rental agreement

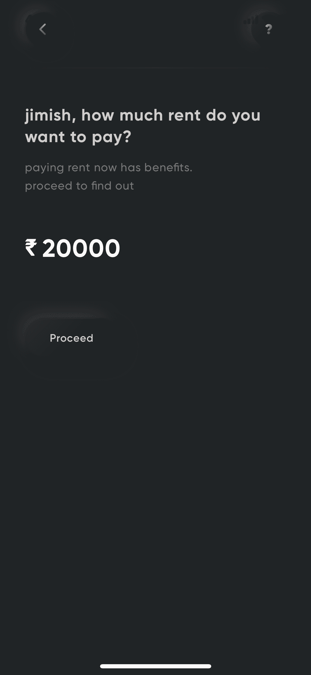

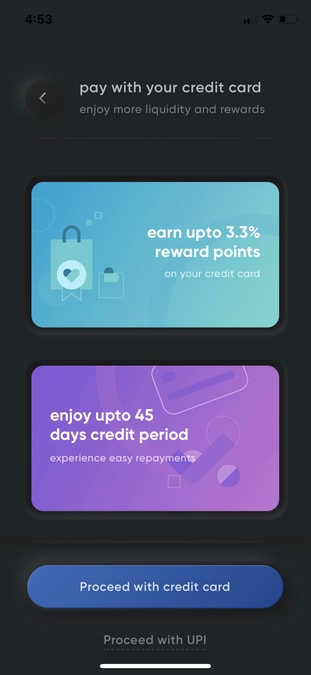

Anyone tried cred to pay rent?

.

Solved

A very detailed and informative post by the admin.

Just to add to it, as per my knowledge, Digital receipts are not useful for claiming HRA exemption but rent receipts are. These receipts are just like payment receipts which you get for transferring funds from any bank to any other bank.

Can someone give a review of redgiraffe. seems like the obvious choice here

redgiraffe dont have Payzapp offer, so no use of it . better go with no broker you will get 500 rs

This topic does not relate to me but informative.

This topic does not relate to me but informative.

I’m paying rent using Nobroker/Payzapp since 3 months, but they never asked for rent agreement.

At what time do u pay, and amount?

Anyone paying rent using hdfc milennia debit card?

I am thinking of, ppl with millenial payzapp nobrkr give reviews

Nice deal

Is there a way to pay rent via amex card without too much charges on Redgiraffe? I need to reach the 1.5Lacs spend requirement for yearly charges waiver.

Follow Us

Follow Us

Also use the Payzapp offer for Nobroker for additional 500rs. cashback

Add biller redgiraffe in payzapp and use BILLPAY promocode to get extra 200 cb 🙂