The Indian Ministry of Finance today announced a hike in the interest rates of several Small Savings Schemes such as the Senior Citizens Savings Scheme, National Savings Certificate, and Monthly Income Amount scheme. These Small Savings Schemes Interest Rates are hiked by up to 70 basis points (BPS) for the April 1st to June 30th quarter. Below is a list of Small Savings Schemes along with their revised interest rates for April 2023 to June 2023.

Small Savings Schemes are schemes launched by the government to provide a safe and secure investment option to the general public. Today, the Ministry of Finance of India at 05:54 PM on Friday, March 31st, 2023 announced a hike of up to 70 basis points on these Small Savings Schemes.

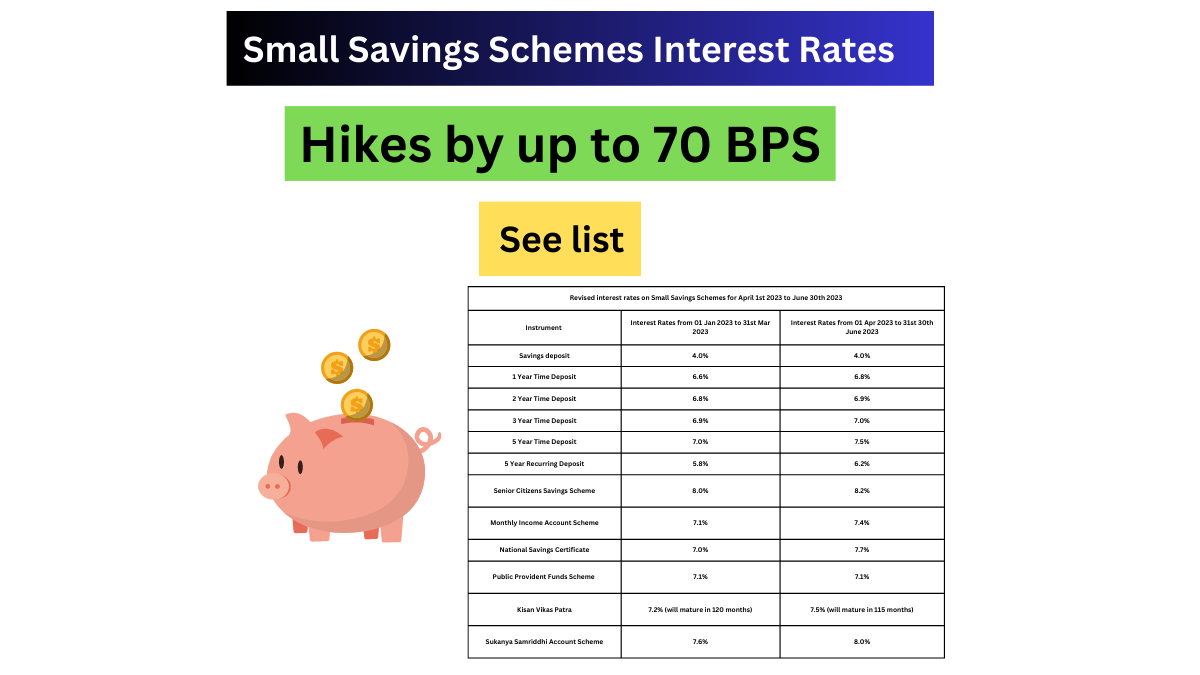

Here’s the official list of the revised interest rates on Small Savings Schemes:

Revised interest rates on Small Savings Schemes for April 1st 2023 to June 30th, 2023 |

Instrument |

Interest Rates from 01 Jan 2023 to 31st Mar 2023 |

Interest Rates from 01 Apr 2023 to 31st 30th June 2023 |

Savings deposit |

4.0% |

4.0% |

1 Year Term Deposit |

6.6% |

6.8% |

2 Year Term Deposit |

6.8% |

6.9% |

3 Year Term Deposit |

6.9% |

7.0% |

5 Year Term Deposit |

7.0% |

7.5% |

5 Year Recurring Deposit |

5.8% |

6.2% |

Senior Citizens Savings Scheme |

8.0% |

8.2% |

Monthly Income Account Scheme |

7.1% |

7.4% |

National Savings Certificate |

7.0% |

7.7% |

Public Provident Funds Scheme |

7.1% |

7.1% |

Kisan Vikas Patra |

7.2% (will mature in 120 months) |

7.5% (will mature in 115 months) |

Sukanya Samriddhi Account Scheme |

7.6% |

8.0% |

As you can see the NSC Scheme (National Savings Certificate) is a Small Savings Scheme with the highest interest rate hike of 70 basis points. While the Public Provident Funds scheme (PPF) has not received any hike in its interest rates.

If we compare the NSC scheme interest rates of 2020 to the latest NSC scheme 2023 interest rates, there’s a jump of 90 basis points in the last two years, and the average for the overall Small Savings Schemes’ interest rates hike is around 140 basis points per year as per reports.

Recently the government also increased the deposit limit from 15 Lakhs to 30 Lakhs for the Senior Citizens Savings scheme. The recent 2023 Union budget has given a big push to Small Savings Schemes.

What are your thoughts on this? Do share with us in the comments below.

Source: Official Announcement about Small Savings Schemes interest rate hike from the Ministry of Finance of India on Twitter

Thanks to our dimer @BAT_MAN for also sharing this news with us and our community. You can check out the thread here - Revised rates for small savings schemes (Apr '23 Quarter)

Be sure to also read about Popular Tax Saving Options (other than 80C included) for 2023

Follow Us

Follow Us