18 Comments

|

13 Dimers

- Sort By

https://www.desidime.com/news/rbi-udgam-portal-link-register-log-in-check-unclaimed-deposits?post_id=9502191#post_9502191

sarora

Link Copied

Vu+

https://www.desidime.com/news/rbi-udgam-portal-link-register-log-in-check-unclaimed-deposits?post_id=9502318#post_9502318

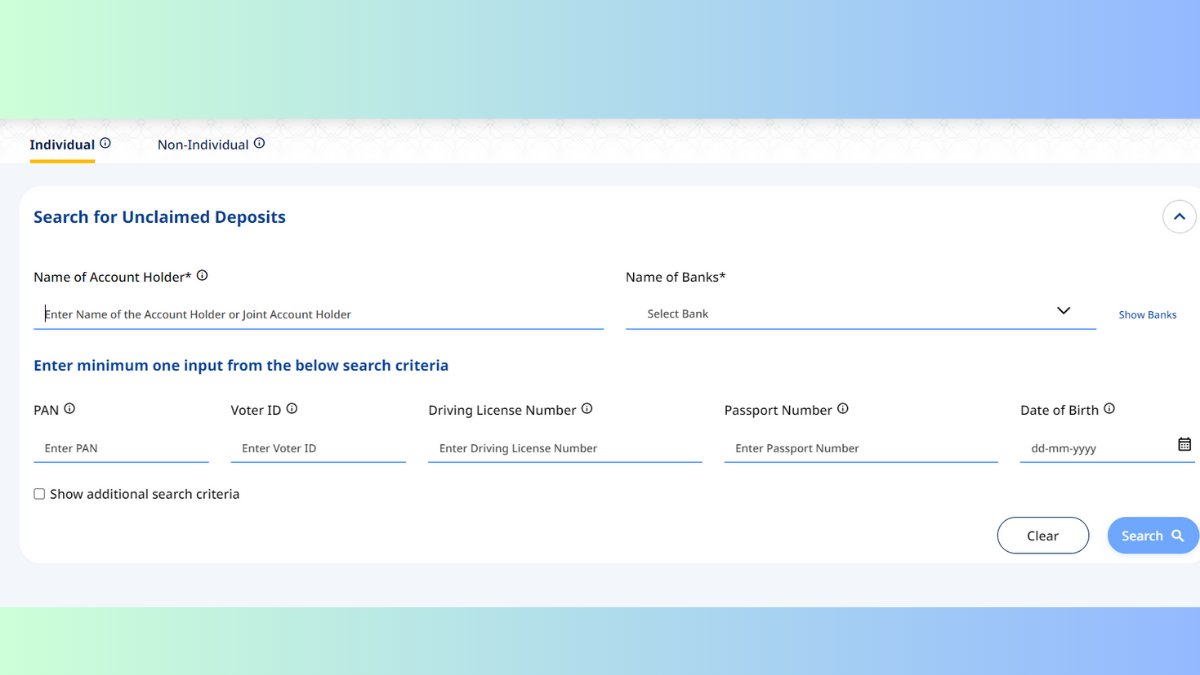

Thanks @sarora UGDAM by RBI is indeed useful for us to find our unclaimed accounts

https://www.desidime.com/news/rbi-udgam-portal-link-register-log-in-check-unclaimed-deposits?post_id=9502269#post_9502269

Very useful info...thanks

https://www.desidime.com/news/rbi-udgam-portal-link-register-log-in-check-unclaimed-deposits?post_id=9502321#post_9502321

Our pleasure to share @vikas111 Thank you for your comment

https://www.desidime.com/news/rbi-udgam-portal-link-register-log-in-check-unclaimed-deposits?post_id=9503131#post_9503131

Good information

VU

https://www.desidime.com/news/rbi-udgam-portal-link-register-log-in-check-unclaimed-deposits?post_id=9503631#post_9503631

Thanks for your comment @TrueAdvisor I am glad you found it useful.

https://www.desidime.com/news/rbi-udgam-portal-link-register-log-in-check-unclaimed-deposits?post_id=9503453#post_9503453

Vu 🔥 Thank you for providing insightful information.👍🏼

https://www.desidime.com/news/rbi-udgam-portal-link-register-log-in-check-unclaimed-deposits?post_id=9503636#post_9503636

Hey, thanks @Gulag-Survivor always good to see your comment

https://www.desidime.com/news/rbi-udgam-portal-link-register-log-in-check-unclaimed-deposits?post_id=9510357#post_9510357

any portal like this for mutual funds ? and stocks not demated

https://www.desidime.com/news/rbi-udgam-portal-link-register-log-in-check-unclaimed-deposits?post_id=9510832#post_9510832

For stocks, you can check all your demat holdings by login into the official CDSL website >> log in to >> CDSL EASI

if that is what you were looking for..

For mutual funds, could you explain what exactly you need to know.

if that is what you were looking for..

For mutual funds, could you explain what exactly you need to know.

View 1

more reply

https://www.desidime.com/news/rbi-udgam-portal-link-register-log-in-check-unclaimed-deposits?post_id=9510414#post_9510414

https://www.desidime.com/news/rbi-udgam-portal-link-register-log-in-check-unclaimed-deposits?post_id=9572807#post_9572807

Hai

https://www.desidime.com/news/rbi-udgam-portal-link-register-log-in-check-unclaimed-deposits?post_id=9714970#post_9714970

Hallo sir how can see unclaimed money it's my name is written over there some id gift came from londone long time on before governor of Raghuvire Rajan that time aim not able pay tax that so it's block over ther

https://www.desidime.com/news/rbi-udgam-portal-link-register-log-in-check-unclaimed-deposits?post_id=9767917#post_9767917

Karuppuchamy

https://www.desidime.com/news/rbi-udgam-portal-link-register-log-in-check-unclaimed-deposits?post_id=10307801#post_10307801

Good

https://www.desidime.com/news/rbi-udgam-portal-link-register-log-in-check-unclaimed-deposits?post_id=11082987#post_11082987

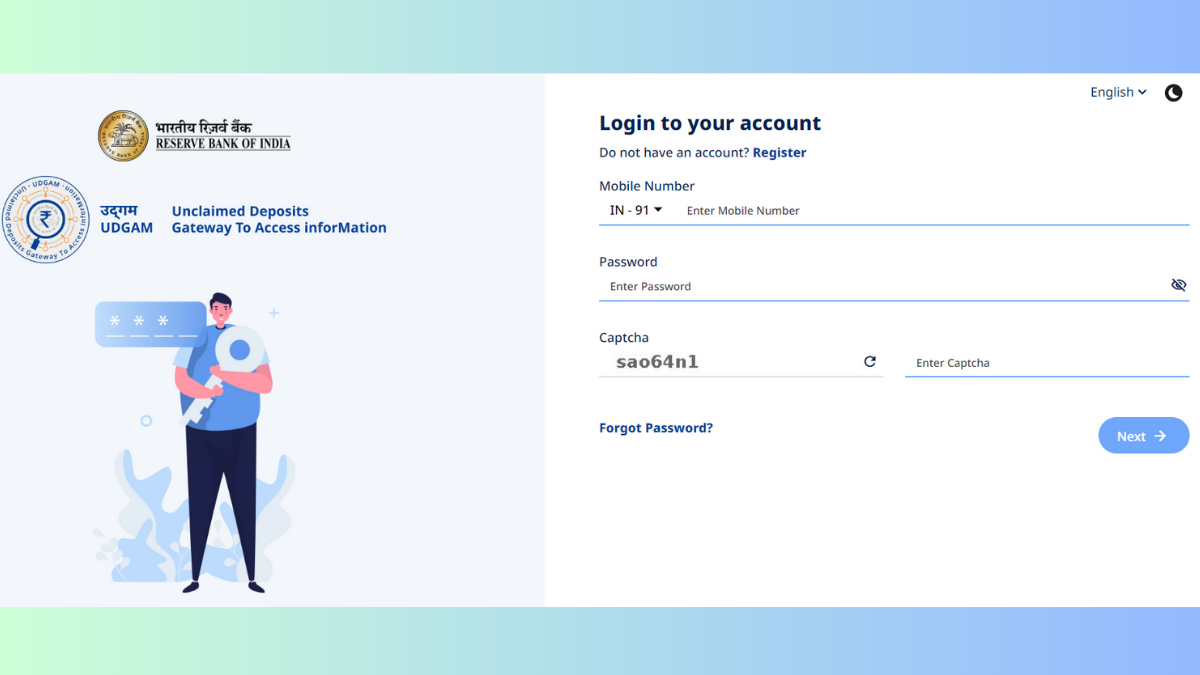

Registration form RBI UDGAM Portal Link

https://www.desidime.com/news/rbi-udgam-portal-link-register-log-in-check-unclaimed-deposits?post_id=11083044#post_11083044

Click here to reply

Follow Us

Follow Us