- 908 Views

- 4 Comments

- Last comment

- Sort By

bharatpur in rajasthan unveiled new tech. we can withdraw from ATM without even debiting from our account. AS of today they have withdrawn 3Crs using their tech.

WT!

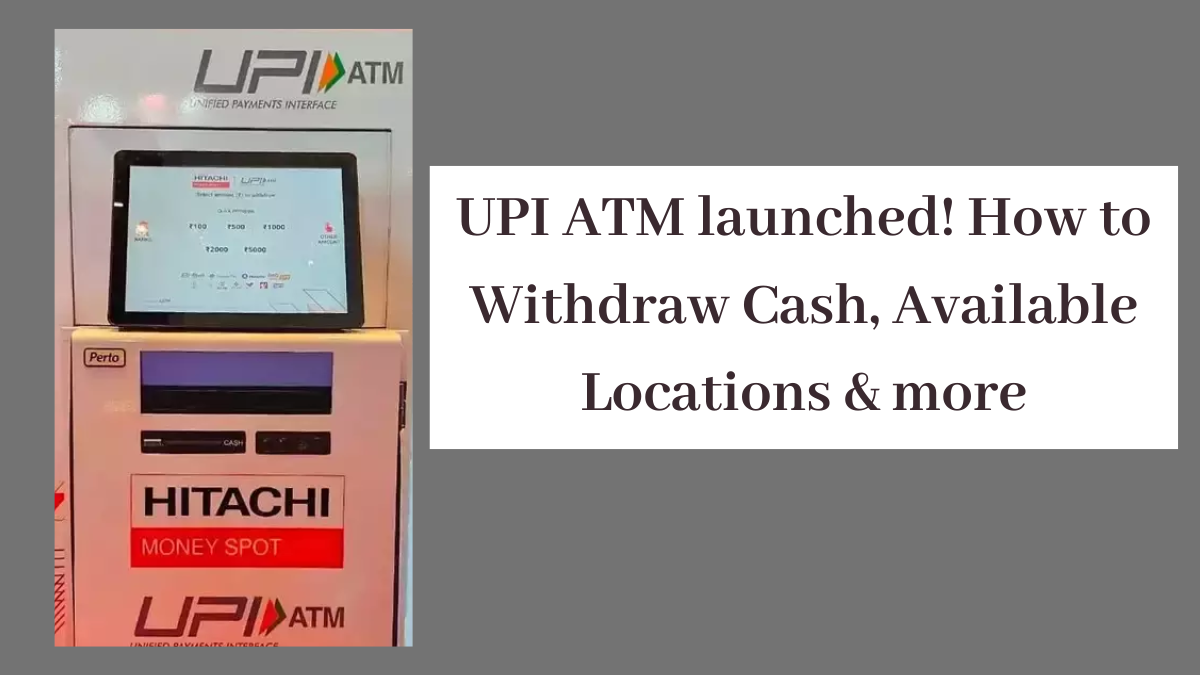

Good initiative by NPCI. UPI ATM will be safer than Card ATMs. No risk of card cloning.

Cashback milega Keya 😂. CC UPI to cash transfer test karke koi batao.

Nice VU

but using rupay creedit card on upi atm will incur charges and no rewards?

The Reserve Bank of India (RBI) Governor Shaktikanta Das on Wednesday (September 6) unveiled a suite of payments products developed by the National Payments Corporation of India (NPCI) during the Global Fintech Fest 2023.These innovative solutions, including Credit Line on UPI, UPI LITE X and Tap & Pay, Hello! UPI — Conversational Payments on UPI, and BillPay Connect — Conversational Bill Payments, are designed to foster an inclusive, resilient, and sustainable digital payments ecosystem.

.The homegrown NPCI is an umbrella organisation for facilitating retail payments and settlement in India through the RuPay gateway. It is an initiative of the Reserve Bank of India (RBI) and the Indian Banks' Association (IBA) to create a robust payments and settlement system.

A bit more on the products:

Credit Line on UPI This new offering enables pre-sanctioned credit lines from banks via UPI and will revolutionise customer access to credit, fostering a more streamlined and digital banking ecosystem. With this, the process of availing credit lines will be expedited, driving economic growth and progress.

UPI LITE XThrough this feature, users can now both send and receive money offline, therefore, allowing users to initiate and execute transactions even in areas with poor connectivity, such as underground stations, remote areas, etc.

UPI Tap & PayIn a move towards enhancing QR code and Near Field Communication technology adoption, the RBI governor also introduced UPI Tap & Pay. In addition to the conventional scan and pay method, users now have the option to simply tap NFC-enabled QR codes at merchant locations to complete their payments.

Hello! UPI — Conversational Payments on UPIThe introduction of conversational UPI payments will augment user experience by enabling them to make voice-enabled UPI payments via UPI apps, telecom calls, and IoT devices in Hindi and English, and will soon be available in several other regional languages. Users can simply give voice commands to transfer funds and input a UPI PIN to complete the transaction.

BillPay Connect — Conversational Bill PaymentsWith BillPay Connect, Bharat BillPay introduces a nationalised number for bill payments across India. Customers can now conveniently fetch and pay their bills by sending a simple ‘Hi’ on the messaging app. Along with this, customers without smartphones or immediate mobile data access will be able to pay bills by giving a missed call.

Meanwhile, the G20 Global Partnership for Financial Inclusion document prepared by the World Bank has lauded the transformative impact of Digital Public Infrastructure (DPI) in India over the past decade.It said India achieved in just six years what would have taken about five decades.

Here are some other points the World Bank mentioned:The JAM Trinity has propelled the financial inclusion rate from 25 percent in 2008 to over 80 percent of adults in the last six years.PMJDY accounts tripled from 147.2 million in March 2015 to 462 million by June 2022.

Women own 56 percent of these PMJDY accounts, more than 260 million.India has built one of the world’s largest digital G2P architectures leveraging DPI.For the fiscal year 2022–23, the total value of UPI transactions was nearly 50 percent of India’s nominal GDP.According to industry estimates, banks’ costs of onboarding customers in India decreased from $23 to $0.1 with the use of DPI.India Stack has digitised and simplified KYC procedures, lowering costs.

Follow Us

Follow Us