Let’s be honest, instant loan apps are something you’re better off avoiding. Bank personal loans are way safer, and usually much cheaper too. But we get it, sometimes, when you're in a tough spot, you don’t have many options. And with like 100 different instant loan apps floating around (half of them are shady Chinese apps that’ll threaten or harass you if you miss even one EMI), it can get overwhelming. That’s why we put this article together—not to tell you the “best instant loan app in India”, but to help you find the least bad one at least. After a lot of time & effort, we have jotted down the 5 instant cash loan apps in India in 2025, their charges, interest rates, pros and cons and everything important you must know.

Let’s begin: Reviewing & Comparing the 5 Popular Instant Loan Apps in India

.

Top 5 Popular Instant Loan Apps: Which is the Least Bad One?

While researching for some instant cash loan apps, we came across a few names that we saw repeating frequently. So we decided to compare and find out if these apps truly are the best instant loan apps as many claim them to be? Let’s find out.

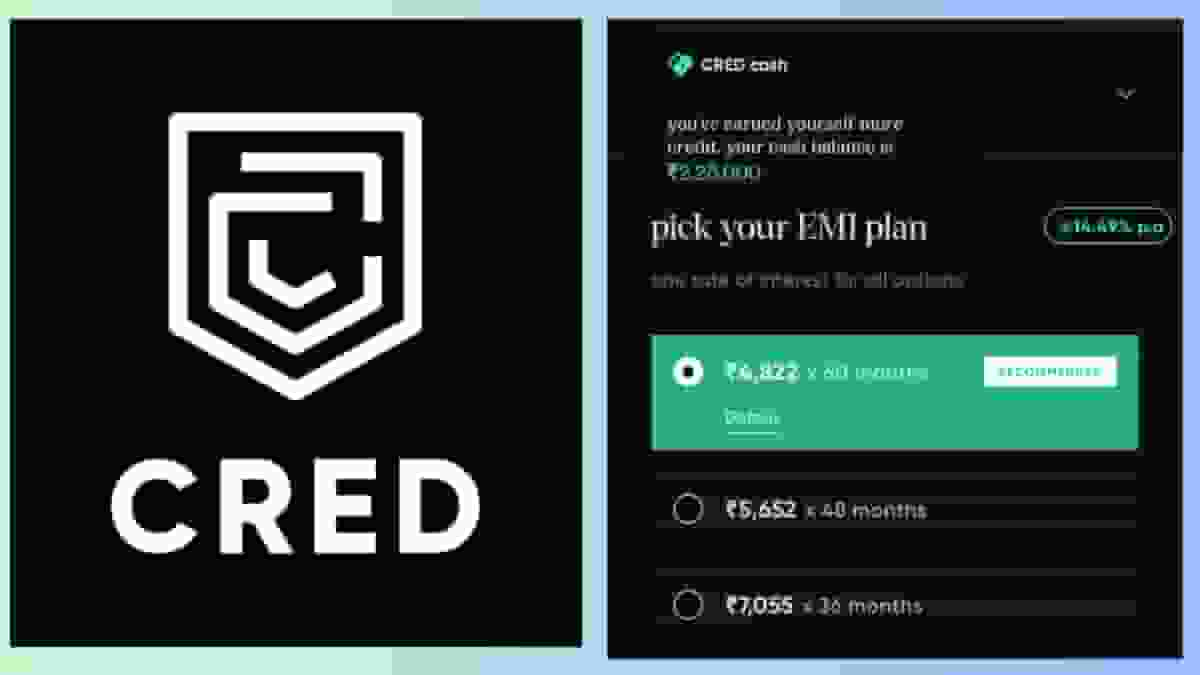

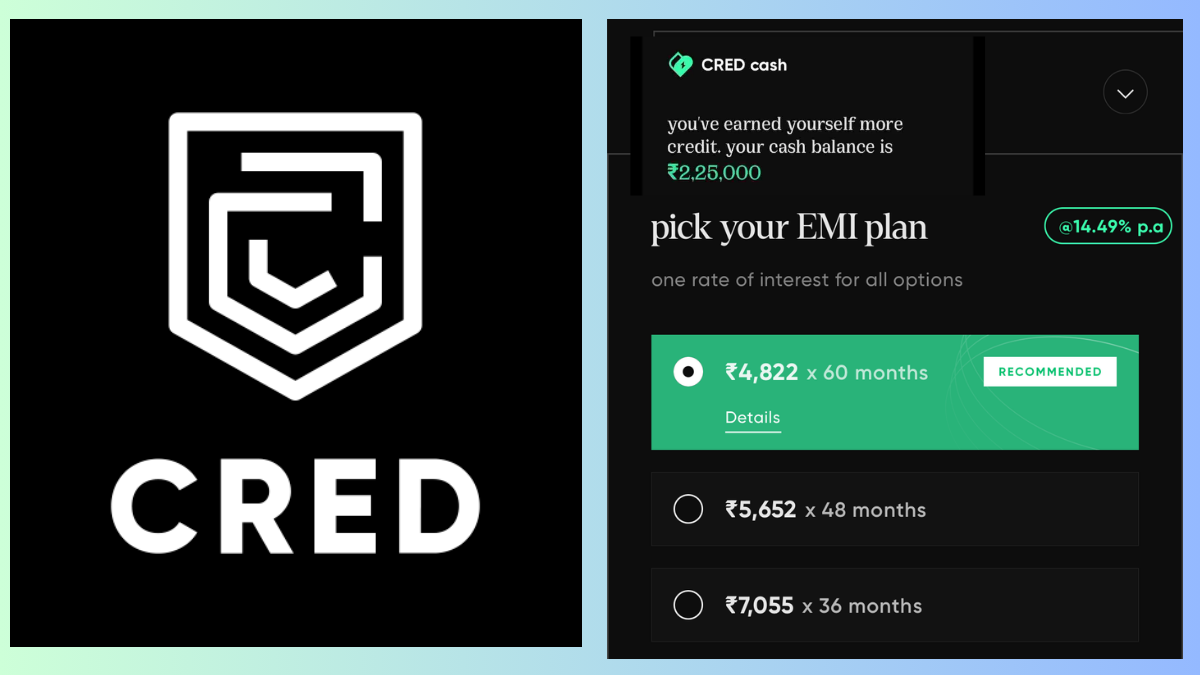

1. Cred Cash (Credit Line without Income Proof)

Cred Cash is a credit line offered to Cred users without submitting any income proof. Users do need to do their online KYC (Aadhar & PAN Card verification) to avail it. To get access to Cred Cash loan, you must have at least some history with Cred of paying your credit card bills on time. This credit line is offered in partnership with IDFC Bank. Since it is a credit line, it totally depends on users when & how much funds they wish to draw. Initially Cred offers about ₹50,000 to ₹5,00,000 as credit line (may vary) which increases further after a user completes paying their previous cred cash loan successfully & on time.

What makes Cred Cash a good instant loan app to use?✅

No foreclosure charges on the loan (on both part & full repayment).

Cred Cash offered us an interest of 15.99% (may vary) for a loan of Rs.21,000, cheaper than Navi who offered us 20% interest for the same amount.

Normal 2% to 2.5% processing fee (save more with Cred Cashback Deals)

No 18% GST on penalty charges, processing fee, etc like HDFC probably applies.

Get an instant credit line of Rs.50,000 or more without submitting income proof (ITR, income receipts, etc). KYC is needed.

Select your own tenure (3 months, 6 months, 12 months, 18 months, etc). Banks do not generally offer short tenure loans (like on HDFC 1.5 Lakh loan has a fixed repayment tenure of 12 months)

Get documents like Loan Agreement and Statement of Account (SOA) anytime from the Cred app

.

What we don’t like about Cred Cash❌:

In some cases, they don’t update the credit department that you’ve closed the loan timely. So the loan still shows active in some cases or worse, affects your credit score (even if you paid the loan on time). However, recently they have made an update to their policy now in which they report each loan separately in the bureau to show a user’s repayment history clearly which helps in better tracking.

Lack of customer support from Cred. Apart from automated bot responses, there’s not much.

Important Tip for using Cred Cash instant loan:

If you took a loan from Cred and paid it fully but still the loan shows active, do not keep any high hopes from Cred customer support. Instead, reach out to the IDFC nodal grievance redressal officer. You can find the phone number & email ID in your loan agreement document (which you can download from Cred app). ✔️✔️✔️

Important update to Cred Cash: Cred has now launched Cred Cash Plus, instant loan against mutual funds at 8.99% interest for a select group of users currently. ⭐⭐⭐

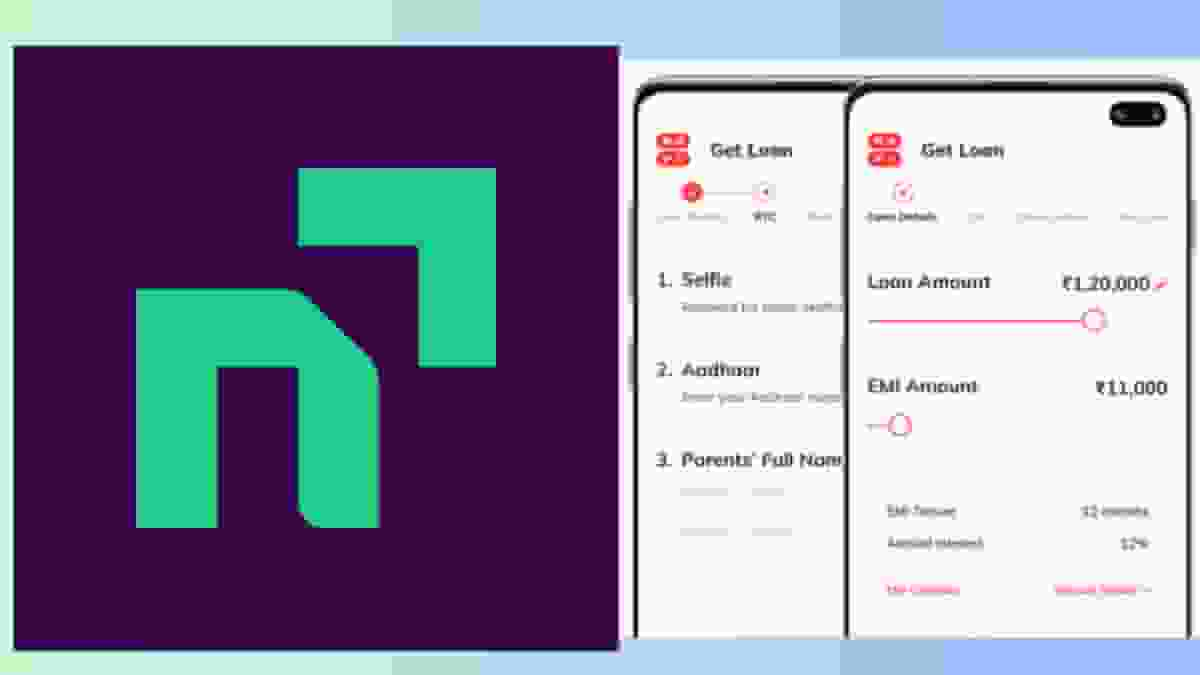

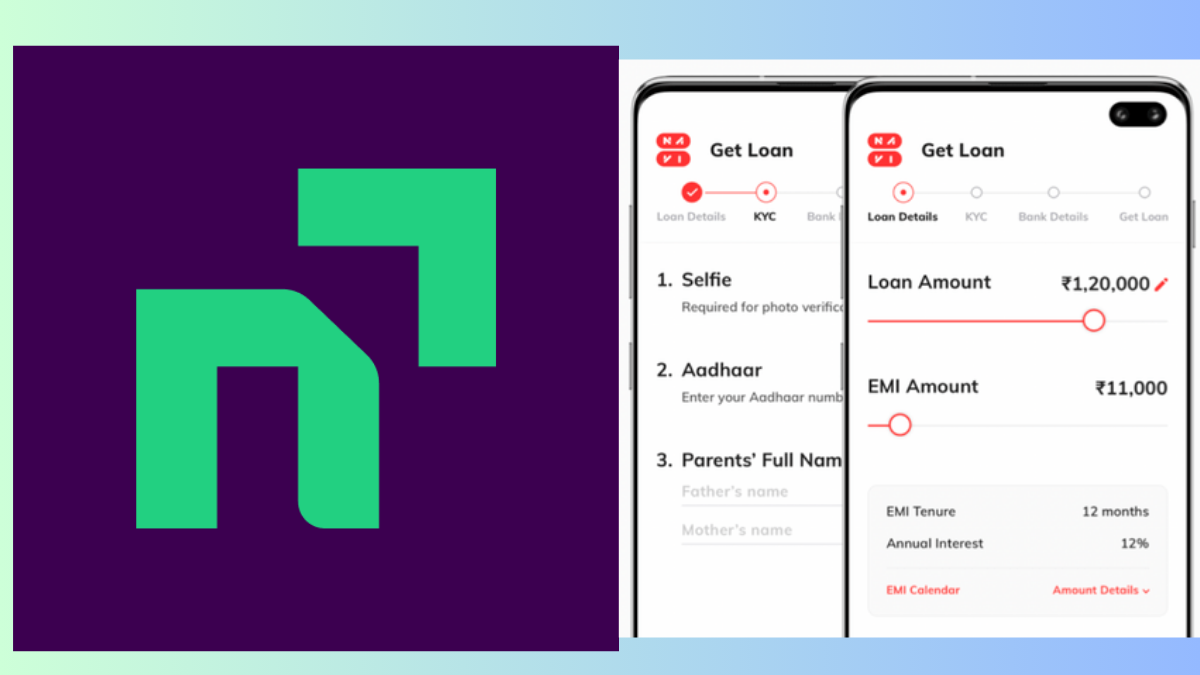

2. Navi: Instant Loan App with Zero Foreclosure Charges

In almost every list of the best loan apps in India, you’d find a mention of Navi. Just like the rest of the instant loan apps, Navi has mixed reviews of both, happy as well as unhappy borrowers. Unlike most other instant loan apps, Navi is a direct NBFC (Navi Finserv) and also has some co-lending partners like Bajaj Finance, Aditya Birla Capital, Piramal Capital, etc. The interest rates start from 9.9% pa and go up to 45%. The minimum credit score is 700 to 750 and you must be either salaried or self-employed to avail an instant loan on the Navi app. Similar to Cred Cash, there are no foreclosure charges on the Navi app. They also claim to offer zero processing fees.

What makes Navi one of the best instant loan apps to use?✅

Navi is RBI-registered loan app & offers zero foreclosure charges

Get instant loan starting from as low as Rs.10,000 to Rs.200,000

Choose your own monthly EMI (starts from minimum 10% to 4% of total loan amount). For example, for a loan of 10K, the minimum monthly EMI comes around Rs.1000/month (10%) and for a loan of 3.6 Lakh, the monthly EMI comes around Rs.13,400 (3.7%)

They also seem to offer zero processing fees (for select individuals probably) (Be sure to keep checking Navi Offers & Discount Coupons)

What do we not like about Navi loans?❌

Providing permission to your contacts is 100% mandatory to sign up on the app (if you miss even a single EMI, NAVI executives can call your contacts and demand money). If you pay on time, you’ll be safe.

Navi portrays itself as an instant loan app. However, for people with less salary (example, ₹15,000), it rejects applications. This is probably because the interest rate on Navi is pretty high which brings us to our next point.

Navi loans can get expensive - whether you are applying for a Rs.10,000 loan or a Rs.3,60,000 loan, we found Navi to offer us a fixed interest rate of 20% pa. This is very much higher compared to going directly to banks (13%) or via other instant loan apps. Though this may vary for each individual.

Abusing/harassing borrowers & their friends or family even if they miss a single EMI is sadly a common practice amongst many instant loan apps (Navi is no different), but Navi’s customer support is also something we can’t seem to write home about.

Important update to Navi loans: Navi recently launched a credit line on UPI in partnership with Karnataka Bank (read more from our dimers)⭐⭐⭐

Also read: Top Student Loan Apps in India✔️✔️✔️

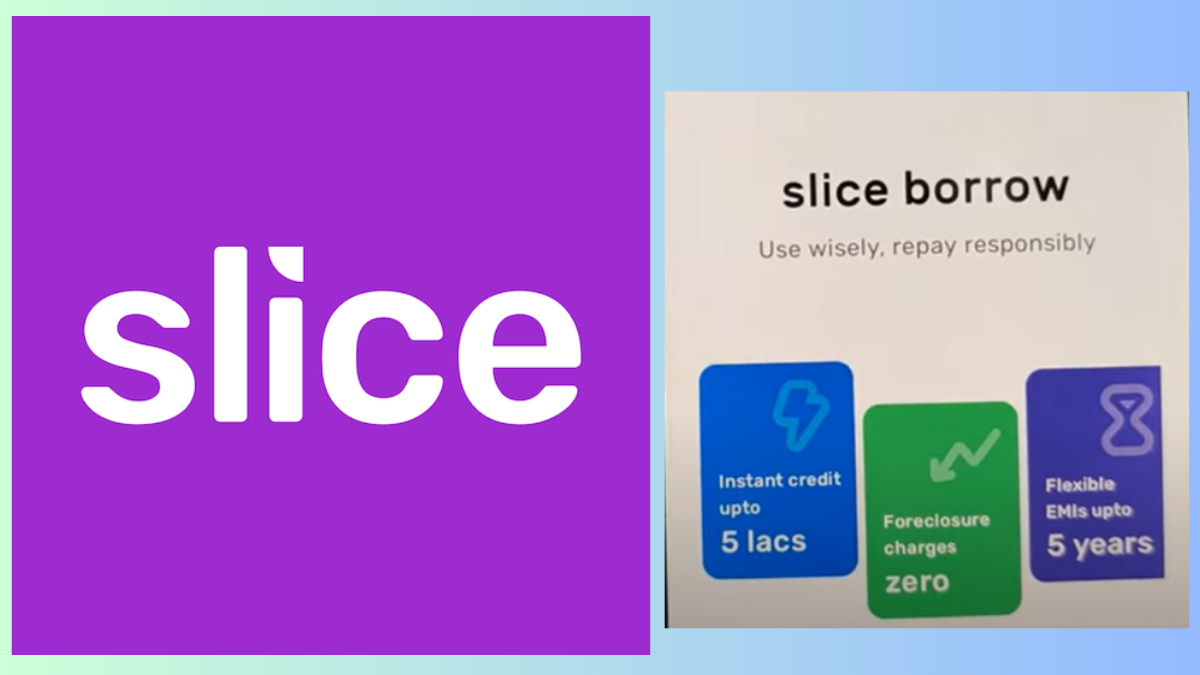

3. Slice Instant Loan App: No interest if loan repaid in 1 Month?

Moving on with reviewing some of the best loan apps in India currently – Slice is a name we are sure you must know. They are known for their tempting benefit - providing an interest-free loan for 1 month. But hold your horses right there, there’s still a 3% processing fee that one needs to pay (make use of Slice Offers & Coupons to make savings). Also, if you miss repaying the full loan amount before 1 month, the APR is around 16% to 36% per annum. The user experience of Slice is also a bit confusing. For example, the app doesn’t allow users to select their loan tenure at first (by default it is 12 months) and the option gets available next month when the bill is generated. The EMI bounce charges are around 3% per month (36% per annum) so be sure to not miss even a single EMI when you take a loan from these instant loan apps. A good thing about Slice is that even students can use it.

What we liked about Slice instant loan app?✅

Slice is partnered with RBI-registered NBFCs like Poonawalla, Vivriti Capital, DMI Finance Ltd, etc.

Students can also check their eligibility for loan by uploading any one document - college ID (should not be expired), college marksheet (should not be more than 1Y old) or fee receipt (should be of existing semester).

Offers interest-free loan for 1 month (3% processing fee is there) Read our dimers’ discussion on Slice 1 month interest-free loan.

Provides all the documents such as KFS, Loan Agreement, etc

Loan amount starts from as low as Rs.100 and goes up to Rs.5,00,000

Tenure is up to 5 years max

When you foreclose, the interest from 2 days after your foreclosure date until the final EMI date is waived off.

What we don’t like about Slice instant loan app?❌

Asks for contacts and media access

Not very transparent on loan tenure

High interest rate of 27% and even 36% for even smaller loans like ₹8,000 etc

Processing fee is 3% when competitor loan apps charge around 2% to 2.5%

Slice is known for not readily updating the credit report of borrowers (read our dimer’s discussion on how to remove Slice Pay from your credit report)

We have heard that it's better to close a slice account if you don't need it. They have a habit of adding new accounts by arbitrarily changing your lender or splitting your credit line to two lenders, and deteriorating your credit score.

.

Also read: Best credit cards for buying gold in India✔️✔️✔️

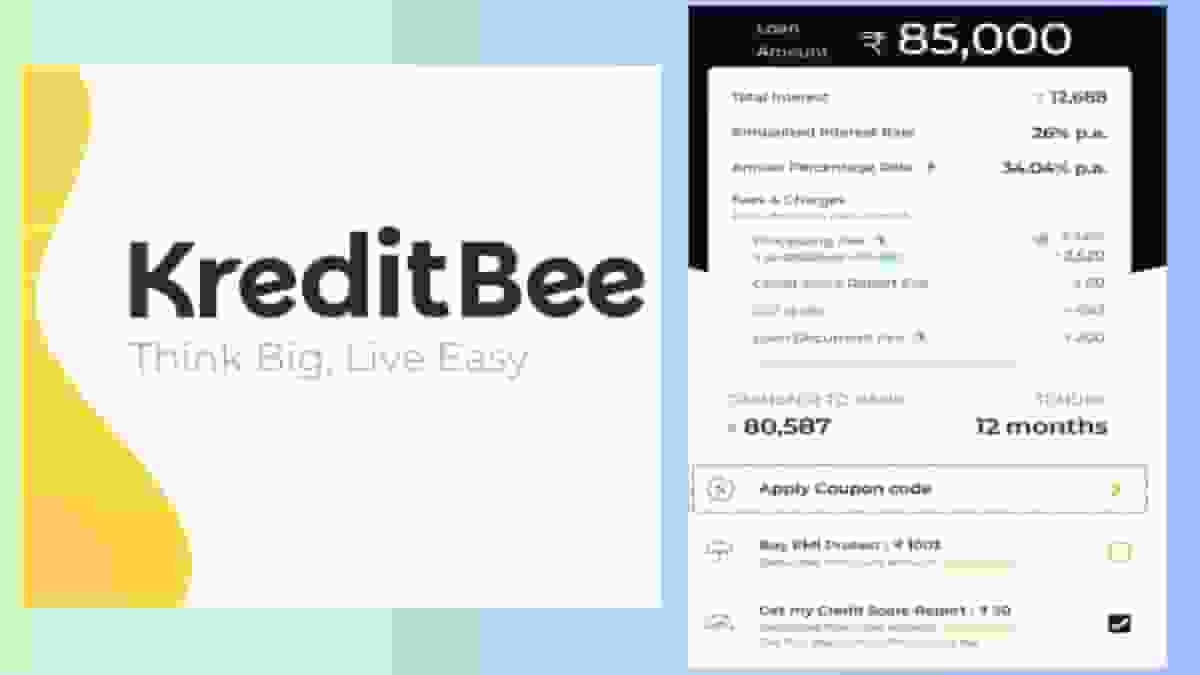

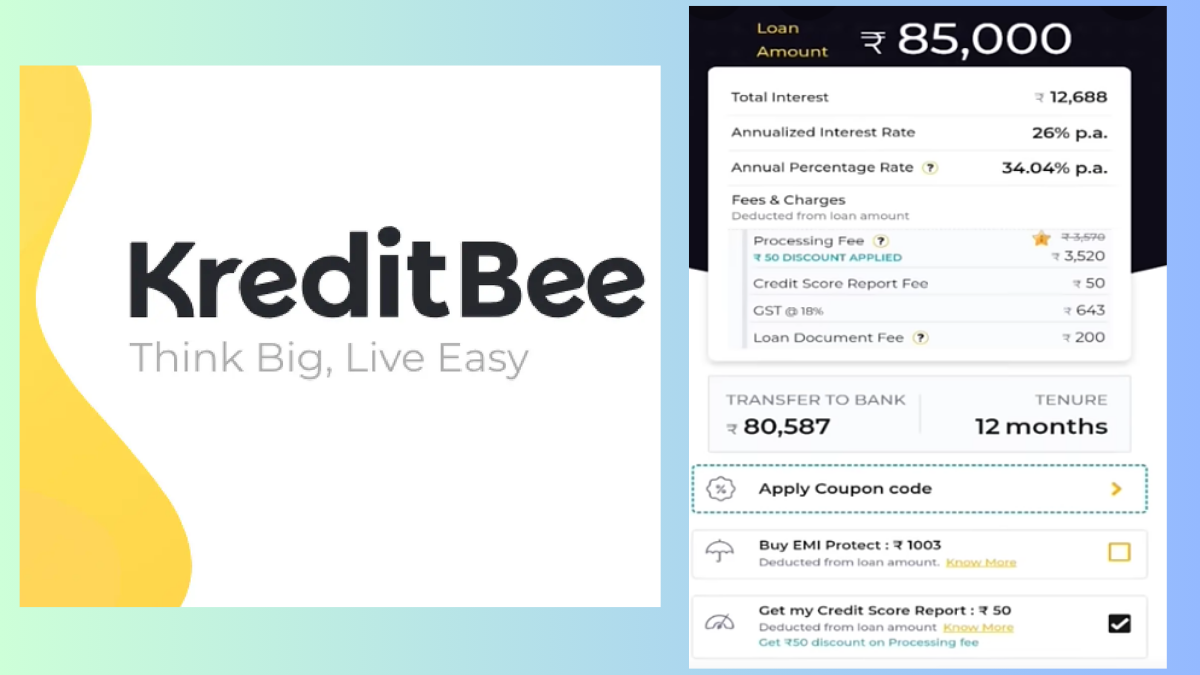

4. KreditBee: Instant Loan from ₹6000 to ₹10,00,000

Whether you like it or not, KreditBee is one of the most popular names amongst instant loan apps in India in 2025. The KreditBee app has over 5 Crore+ downloads and 4.5 stars average rating on the Google Play Store. Kreditbee sanctions its loans via digital lending NBFCs/Banks partners like Piramal Group, PayU Finance, Poonawalla Fincrop, etc.

Loan Amount - ₹6,000 to ₹10,00,000

Interest rates - 12% to 28.5% p.a.

Tenures - 6 to 60 months

APR range - 17% to 50%

Processing Fee up to 5.1% + GST (salaried & self employed)

Processing fee for

Direct transfer to bank account (usually within 15-20 minutes)

Minimum monthly personal income of ₹10,000

Monthly household income more than ₹25,000

What makes KreditBee a good instant loan app to consider?✅

Loan amount starts from as low as ₹6,000 to ₹10 Lakhs (disbursal within minutes)

Select your own tenure (ranges from 3 months to 24 months)

Offers instant loan even with no prior credit or loan history

What we don’t like about KreditBee instant personal loans?❌

For ₹20,000 personal loan, the interest rate starts from 16% + processing fee (2.5%)* + 18% GST which is a bit expensive compared to Cred Cash which offers no GST

Both foreclosure and part-payment charges are there (4% + GST)

There’s an onboarding fee for KreditBee new user - ₹200 + GST (use KreditBee coupons to save)

You need to submit your bank statement (in case you don’t have salary slips) - which might feel a bit tedious but then it's a common norm with most other loan apps.

KreditBee is pretty infamous for spam calls, rude executives, calling friends and family members of borrowers in case you fail to even a single EMI (& in some cases, even after full repayment you keep getting spam calls).

KreditBee might not really be the best loan app in India in 2025 but it is sure to be a popular one which we cannot overlook. Their biggest advantage seems to be that their loans are pretty easily accessible to a common man (no prior history of loans/credit cards is needed).

Also read: Best Loan Apps in India without Income Proof (Discussing forum thread by our dimers)✔️✔️✔️

.

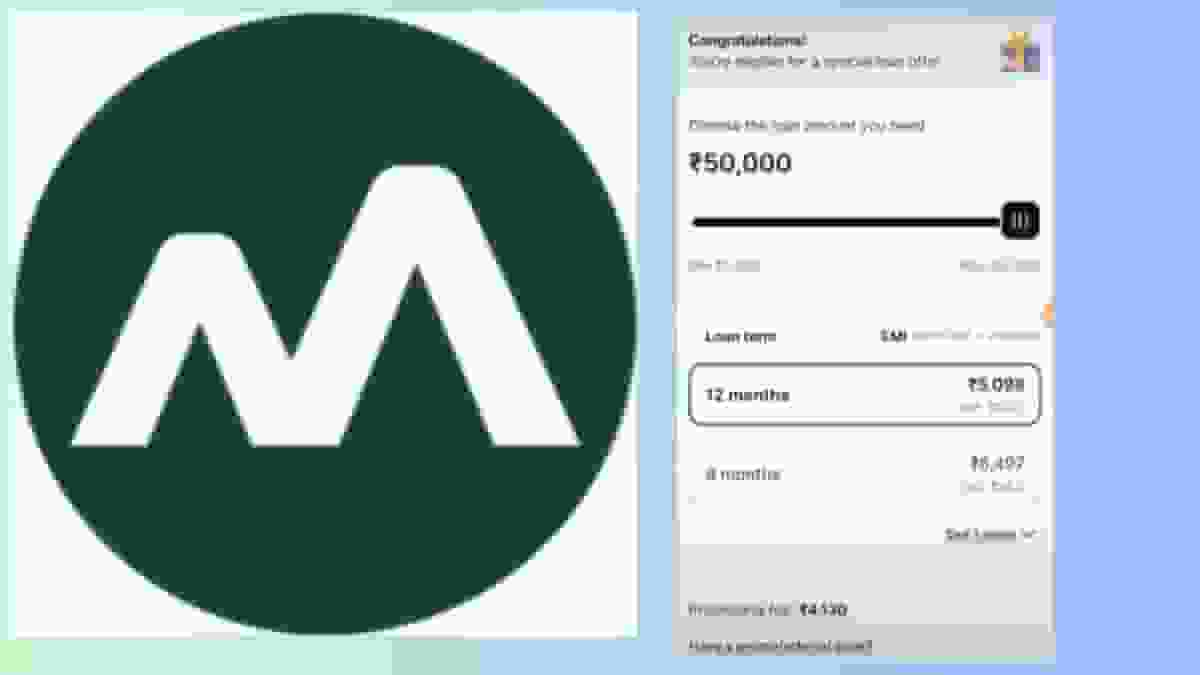

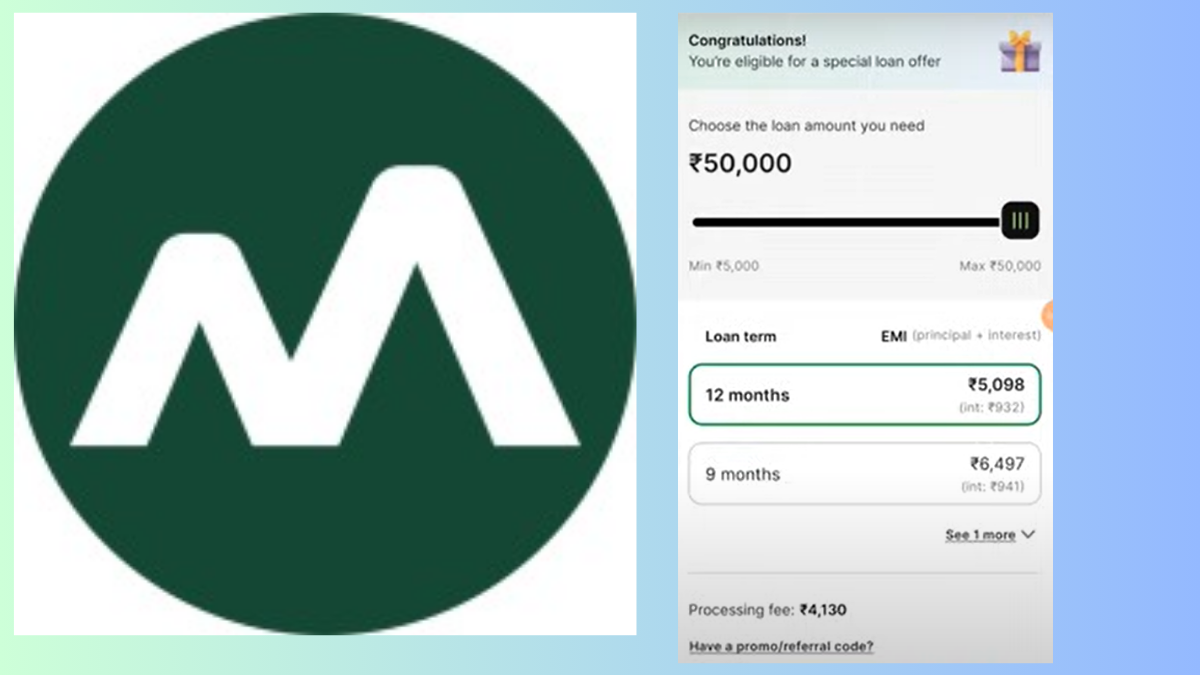

5. Moneyview Instant Loan App in India 2025

Moneyview is considered amongst some of the best instant loan apps in India in 2025 as it reported a sharp 72% YOY growth in 2024. If you are on the hunt for a good instant loan app, we are sure you must’ve heard Moneyview. The interest rate starts from 14% per annum and offers flexible repayment tenure options up to 5 years max. Borrowers can borrow from as low as Rs.5000 and as high as Rs.10,00,000. Moneyview as of April 2025 has over 12 RBI-registered NBFCs as its lending partners including Aditya Birla Capital, DMI Finance, Vivriti, etc. A key thing to know for borrowers is that Moneyview doesn’t allow part-payments. Only foreclosure is allowed after paying a certain number of EMIs.

Loan Amount: From ₹5,000 to ₹10,00,000

Flexible Repayment Tenure: From 3 months to 5 years

Interest rate: Starting from 14% per annum

Annual Percentage Rate (APR): From 17% to 45%*

Foreclosure charges: Not allowed for tenures up to 6 months, foreclosure allowed after 6 EMI payments for loan tenures up to 7 to 18 months and foreclosure allowed after 12 EMI payments for loan tenures over 18 months

What we like about Moneyview Instant Cash Loan App?✅

Moneyview offers loans from RBI-registered NBFCs

Minimum CIBIL required is 650

Minimum income required is around ₹13,500

Choose your own loan tenure (ranging from 3 months to 12 months for small loans like 50K and for bigger loans like 5 Lakh the tenure ranges from 1 year to 5 years)

What we don’t like about Moneyview Instant Cash Loan?❌

Asks for contacts permission

No part payments

Foreclosure is allowed only after paying certain number of EMIs

Its processing fee is quite high, up to 8%. (can save using Moneyview coupons)

For example, it shows us a 7% processing fee i.e. Rs.33,630 processing fee on a 5 Lakh loan amount.

We found the interest rate for Rs.50,000 loan to be around 39% on Moneyview which is of course way too high (this likely happens when you have a poor CIBIL, get salary in cash instead of online or have low salary income like Rs.15,000 to Rs.25,000). This interest rate might change depending on the individual as well.

With this, we come to the end of reviewing some of the best instant cash loan apps in India in 2025. There are probably about a 100 such instant loan apps available in the market. For the beginning we have reviewed these top 5 popular instant loan apps.

Do share with us in the comments below which is the next instant cash loan app that we should review in this article.

We are aware there are more instant loan apps available in the market like OneScore, Pocketly, LazyPay, RapidRupee and many more. Would you like us to discuss some more apps? Do share with us in the comments:) Hope this article helps you out in some way.

Also read: Best BLDC Fans under 3000 budget✔️✔️✔️

Follow Us

Follow Us

Easy access to liquidity comes with uneasy unethical unwritten terms & conditions allowing creditors to extract asmuch as possible mercilessly.

I Appreciate that you covered all aspects so precisely which will definitely help needys unlike those influencers who display only one side of coin and hide other side.

🥂