Top Comments

15 Comments

|

5 Dimers

- Sort By

https://www.desidime.com/news/list-of-banks-that-raised-fd-rates-in-december-2023?post_id=9759630#post_9759630

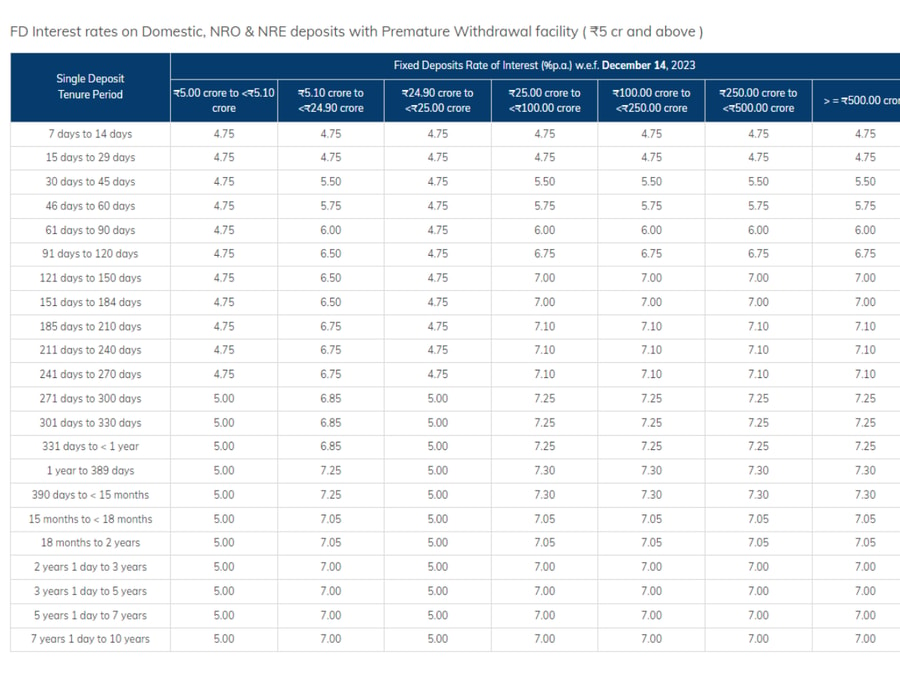

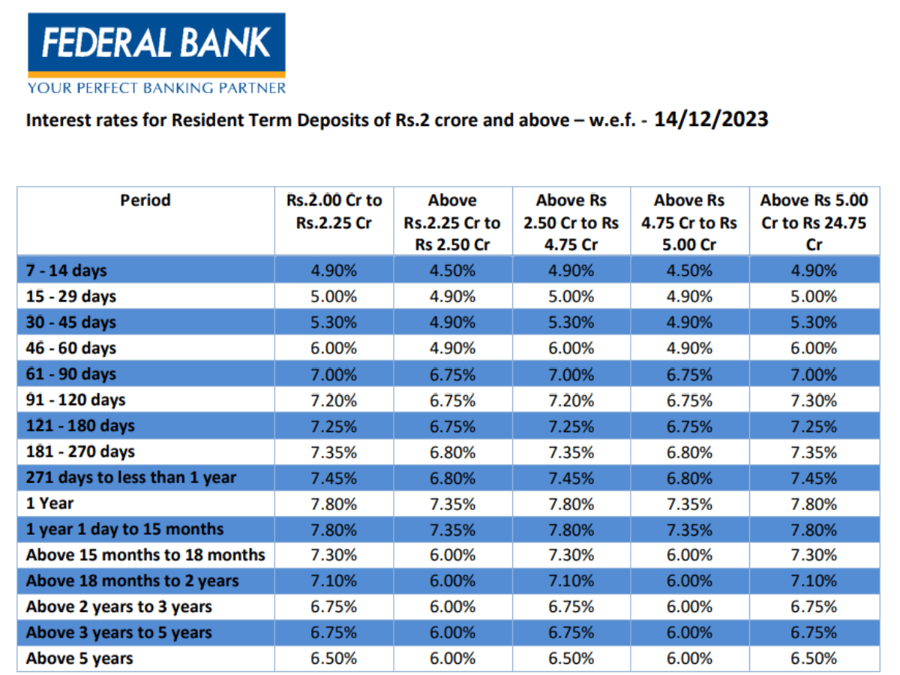

Keeping Rs 2 crore + in fd for mere interest can be workable only to senior citizens , retired people , else its foolishness for the other lot to keep such amount in bank fds rather than exploring other avenues or doing business

https://www.desidime.com/news/list-of-banks-that-raised-fd-rates-in-december-2023?post_id=9759727#post_9759727

Makes sense to me..but I think if I am going to be keeping 2 Cr+ in FD, then perhaps more of my focus would be on parking my money in a safe investment than merely making the most buck out of it.. since that gives me decent returns yearly + perhaps can help tackle inflation..but then there would also be huge taxes of course.. please share if you have any more views on this Loaferg

Edit: Thank you very much for your comment

Edit: Thank you very much for your comment

View 2

more replies

https://www.desidime.com/news/list-of-banks-that-raised-fd-rates-in-december-2023?post_id=9759638#post_9759638

Thank you! Such an article with so much up-to-date data takes quite some effort

https://www.desidime.com/news/list-of-banks-that-raised-fd-rates-in-december-2023?post_id=9759736#post_9759736

Thank you so much @some1anywhere Means a lot!

https://www.desidime.com/news/list-of-banks-that-raised-fd-rates-in-december-2023?post_id=9759712#post_9759712

VU for efforts. Install Stable Money or Moneycontrol. They have higher FD return bank options

https://www.desidime.com/news/list-of-banks-that-raised-fd-rates-in-december-2023?post_id=9759738#post_9759738

Thanks for your comment & suggestion @YSK

https://www.desidime.com/news/list-of-banks-that-raised-fd-rates-in-december-2023?post_id=9759760#post_9759760

@Vrushali.S But those are not entities regulated by RBI or the amount insured by DICGC, are they?

https://www.desidime.com/news/list-of-banks-that-raised-fd-rates-in-december-2023?post_id=9759911#post_9759911

@MoneySavedIsMoneyEarned All Bnaks and NBFCs are regulated by RBI. DICGC insurance is anyway till 5 lakhs and post talks about 2 crore plus. Anyway, my take on the same,

FD beyond 2 crores are for Corporate or HNI. Sr Citizens, yes, can have FDs, but since these FDs can not be prematurely broken, it does not make sense for them to invest here as they might require money anytime and with less hassle. Around 5 to 10% of Sr Citizen's corpus can also be invested in MF to beat inflation, and if they have surplus, even more can be done. Having medical insurance helps them to reduce expenses. For others, it is better to invest in a diversified portfolio like MF, stocks, real estate (may be as it is usually illiquid), bonds, small saving schemes, and FD.

For a salaried person, I like RD over FD as I can invest monthly like SIP.

PS I am not a registered investment advisor, though by education, I have full qualifications to do so. Have an interest in personal finance and manage my own finances.

https://www.desidime.com/news/list-of-banks-that-raised-fd-rates-in-december-2023?post_id=9760049#post_9760049

@arorasid

Good info there @arorasid but there's just one point I doubt here. I do not think all banks are regulated by RBI. Only scheduled banks are regulated by RBI, isn't it?

The list of all the regulated/non-regulated banks in India can be found on this official RBI page - https://rbi.org.in/commonman/English/Scripts/Ba...

View 3

more replies

https://www.desidime.com/news/list-of-banks-that-raised-fd-rates-in-december-2023?post_id=9760836#post_9760836

No sbi, rbl?

https://www.desidime.com/news/list-of-banks-that-raised-fd-rates-in-december-2023?post_id=9760919#post_9760919

Hi, neither of them has revised their FD rates in December and hence. Thanks for your comment.

Click here to reply

Follow Us

Follow Us

VU for efforts. Install Stable Money or Moneycontrol. They have higher FD return bank options

Good info there @arorasid but there's just one point I doubt here. I do not think all banks are regulated by RBI. Only scheduled banks are regulated by RBI, isn't it?

The list of all the regulated/non-regulated banks in India can be found on this official RBI page - https://rbi.org.in/commonman/English/Scripts/Ba...