Jio Financial Services company was started in the year 1999 as Reliance Strategic Investments Limited. The company was later changed to Jio Financial Services and has been a listed stock on the share market (closing price ₹348 as of 30th May). JFL (Jio Financial Limited) recently launched its Jio Finance app in its Beta version. In this article, we will give you a complete walkthrough of the Jio Finance app, features like UPI, Insurance, Wallet payments, Loans and how to download the Jio Finance app.

JFL is also promising some rewards and coupons when using the Jio Finance UPI and bill payment. We tried to verify the same ourselves and have shared what we found in the article below,

There’s also the Jio Payments Bank where users can open their savings account with JPBL and earn an interest rate of 3.5%, get a digital passbook and some users claim to receive a RuPay Platinum debit card as well. Keep reading to know it all.

Jio Finance (JFL) App Launch

Jio Financial Services Limited (JFL) launched its very first Jio Finance app on May 30th, 2024. Using the app, customers can make UPI payments, pay their electricity, gas pipeline, LPG cylinders, FASTag bills and even view their finances & wealth details in one place using the My Money feature on the Jio Finance app.

Speaking on the launch, the company wrote “Future plans include expanding loan solutions, starting with Loans on mutual funds and progressing to home loans”

Jio Financial Services App Download (How to Install & Use)

To download the Jio Financial Services app, users need to visit the Google Play Store. Currently, it seems the Jio Financial app is only available to download for Android users.

How to download & use the Jio Financial Services app?

Visit this link to download the Jio Finance app from the Play Store

Once the download is complete, users need to sign up with their phone number

Enter your phone number & OTP to log in

You can now explore all the features of the Jio Finance app (in Beta)

Jio Finance UPI | What rewards did we get for our 1st UPI transaction?

Coming to one of the most exciting features of the Jio Finance app, is its UPI, Scan & Pay feature. Almost all major UPI apps in the country such as Paytm, Cred, PhonePe, and Gpay offer cashback, coupons and rewards on UPI payments to increase their user retention.

Jio Finance UPI being a new launch, users have some high expectations for UPI rewards and offers. So we decided to give the Jio Finance UPI a try and see what rewards JFL would provide us as a first-time user of their service.

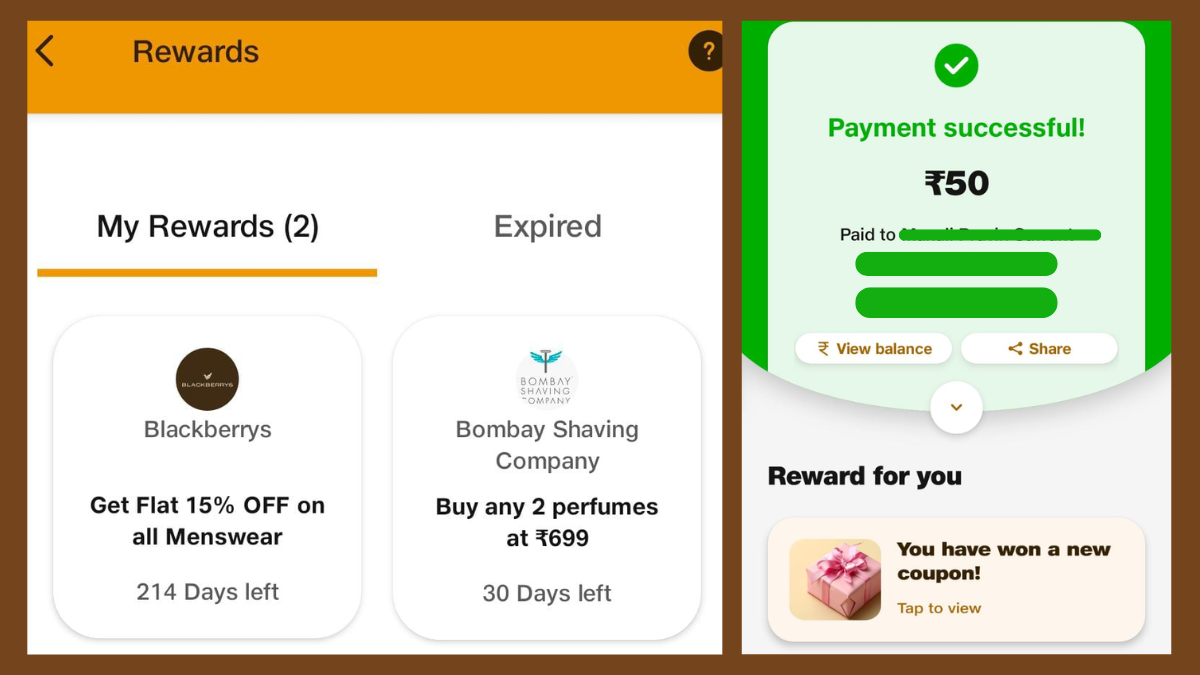

The results? Not the homerun we were expecting. We tried the Jio Finance UPI Scan & Pay and paid 50 bucks for which in return, Jio rewarded us with 2 coupon codes, one from Bombay Shaving Company and one coupon code for Blackberry Menswear.

Did the coupon codes work? Yes, the Blackberry code we received as a reward for using Jio Finance UPI did work and helped us get this formal shirt costing Rs.3495 at a discounted price of Rs.2970. The Bombay Shaving Company code also worked like a charm and got us 2 sets of the Veleno premium perfume costing Rs.1995 each (₹3990 total bill) at a discounted combo price of Rs.699.

Overall, the rewards though weren’t that useful to me as a user, they were pretty decent and sure can be useful to those who wish to buy similar products at a discount. The UPI transaction was smooth & quick.

Jio Financial Insurance service in the Jio Finance app

With the Jio Finance app, JFL is also foraying into insurance across Life, Health, Bike, and Car categories. Interested customers have the option to choose from several renowned partners such as ICICI Lombard, Aditya Birla Capital, HDFC Ergo General Insurance, Tata AIG and more.

Similar to how comparing insurance from different partners is important, it is also important to compare and find the best credit card that suits your needs and spending capacity.

Check out our latest Credit Card Offers page and compare the best credit cards for you.

Join our Whatsapp Deals Group channel to never a miss hot deal such as this one:

Jio Financial App Wallet (PPI) Payment

One of the interesting features of the Jio Finance app is that users can load money in their Jio Payments Bank wallet and do seamless cashless transactions. There’s also a possibility of earning rewards on wallet load and payments. Currently users can load up to ₹10,000 maximum in their wallet.

Jio Financial App Loan Feature

Jio Financial app loan feature is probably one of the buzzing services that compete directly with other UPI apps offering loan services such as Paytm. The Jio Finance app loan interest rates and limits is unknow as of now as the feature is still in Beta launch.

Also read: Home Loan Payment Offers Right Now (2024)

Jio Payments Bank Savings Account, Interest Rate, Debit Card & more

Last but not least, with the newly launched Jio Finance app, Jio has also brought its Jio Payments Bank under the same roof. Though Jio Payments Bank as a subsidiary has existed even before. Thanks to the likes of Jio Pay business which focuses on solving business-payments-related needs.

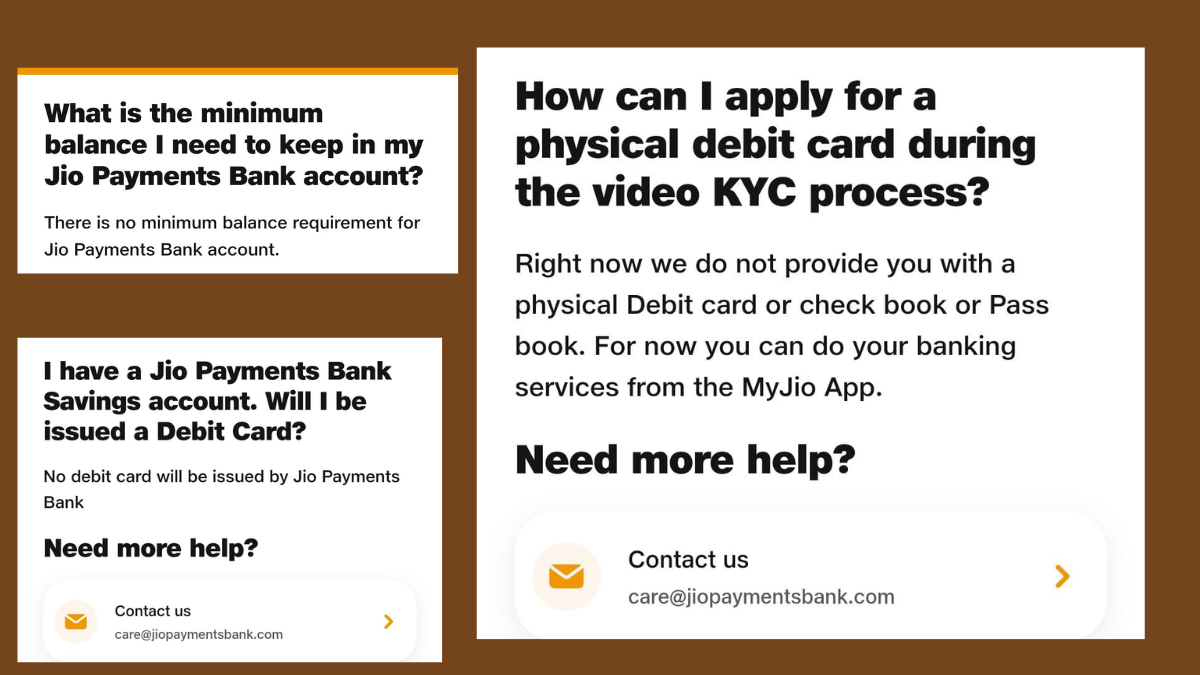

For consumers, the Jio Payments Bank will work as a digital bank wherein users can open their savings bank account, get their digital passbook, easily receive and send money, etc. The interest rate is set to be 3.5% as of now paid quarterly. Can Jio Payments Bank customers receive a debit card too? Well, that's a bit of a mystery. The official FAQ suggests that the company doesn’t provide a debit card to its customers while some dimers from our community suggest that customers can get a virtual platinum Rupay debit card. Since the app is still in its Beta version, we will have to wait a bit to get more clarity on that.

Moreover, there’s no minimum account balance requirement as such for Jio Payments Bank customers.

So this was all about sharing the Jio Finance app launch, UPI scan & pay, rewards, loan and insurance feature and how to download the Jio Financial Services app.

Thanks to @ashb009 for also sharing this news with us here:

New Jio Finance App - UPI Banking, Loans, Insurance Finally Launch

Also read:

Air India Express's Time to Travel Sale is live!

JioCinema 299 Plan for 1 Year

Follow Us

Follow Us